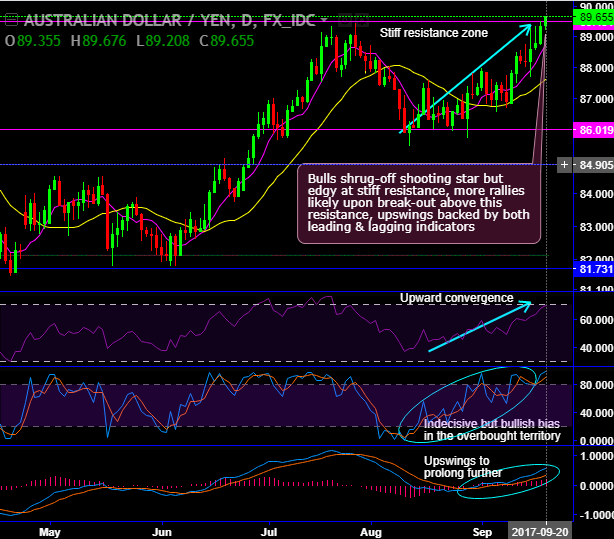

On the rallies of AUDJPY, shooting star pattern candlestick has occurred at 88.760 levels.

But vigorous bulls on these rallies have been shrugging-off this bearish pattern (shooting star) but for now, it seems to be little edgy at stiff resistance of 89.491 levels.

We see stiff resistance at peaks of 89.491 levels, historically, the rallies are hampered at these stiff resistance levels, where doji pattern candlestick also evidences weakness at the same juncture.

The extension of the ongoing rallies seems most likely upon break-out above this resistance, where upswings are backed by both leading & lagging indicators.

On a broader perspective, bulls have managed to retrace more than 50% Fibonacci levels and bounce back above 7-EMAs levels in consolidation phase. Last month, the prices have dipped to test support at 7EMA levels, to counter this bearish effect, this month bulls have bounced back (refer this month’s candle), you could easily make out again a strong support is seen at 7EMA levels and price spikes.

The uptrend likely to extend further only on breach and sustenance above 89.491 levels as bullish EMA crossover to substantiate the bullish stance.

Most importantly, MACD has no deviation from the buying trend sentiment, indicates the uptrend is likely to extend further on both timeframes.

Trade Tips:

Well, contemplating above stated technical reasoning, on speculative grounds we advise bidding one touch binary call options to participate in ongoing uptrend.

This strategy is likely to fetch leveraged yields than spot FX and certain yields as long as the underlying spot FX keeps rising higher.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 148 levels (highly bullish), while hourly JPY spot index was at shy above -78 (bearish) at the time of articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?