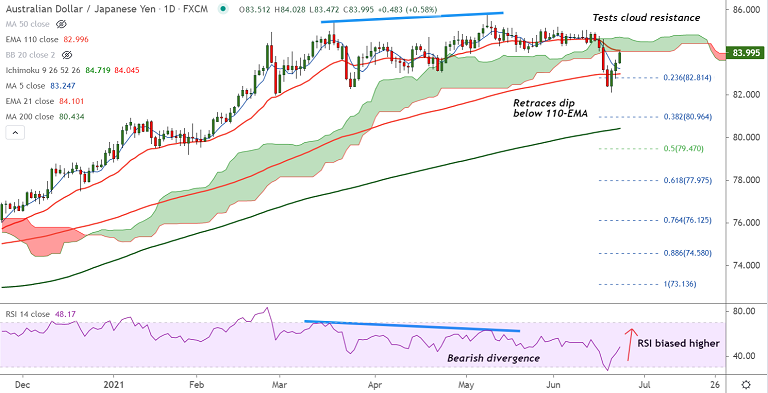

AUD/JPY chart - Trading View

Spot Analysis:

AUD/JPY was trading 0.62% higher on the day at 84.02 at around 10:35 GMT

Previous Week's High/ Low: 84.93/ 82.38

Previous Session's High/ Low: 83.65/ 82.78

Fundamental Overview:

Reserve Bank of Australia (RBA) Assistant Governor (Economic) Luci Ellis said that the board remains committed to “maintaining highly supportive monetary conditions.”

Escalating between Australia and China exert downside pressure on the antipodeans.

Data from Japan released earlier today revealed that the Jibun Bank Manufacturing PMI declined to 51.5 in June from 53 in May.

Further, the latest inflation print from Japan continues to point to deflationary pressure.

The Bank of Japan's (BoJ) April meeting minutes showed on Wednesday that a few members saw the pickup inflation lacking strength.

Minutes suggest that the BoJ is unlikely to abandon its ultra-loose policy any time soon.

Technical Analysis:

- AUD/JPY has edged above 200H MA

- RSI and Stochs have rolled over from oversold levels and are biased higher

- GMMA indicator shows a bullish shift on the intraday charts

Summary: AUD/JPY has retraced dip below 110-EMA and is testing daily cloud resistance. Breakout above cloud will see upside resumption.