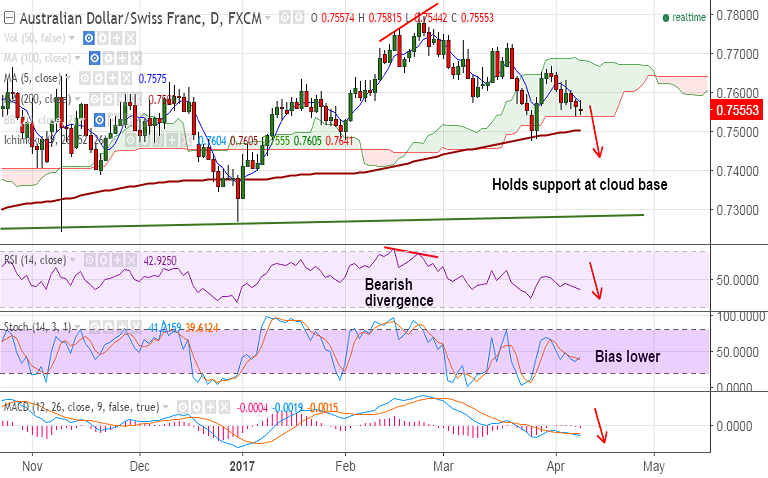

- AUD/CHF has been rejected at session highs at 0.7581, intraday bias lower.

- The pair finds strong support by daily cloud base at 0.7538, break below will accentuate weakness.

- Technical studies are bearish, break below daily cloud raises scope for test of 200-DMA at 0.7502.

- Violation at 200-DMA to see test of 0.7475 and then 0.7435 (Nov 11 low).

- On the flipside we see bearish invalidation only on close above 5-DMA at 0.7575.

- Close above 5-DMA could take the pair to 20-DMA resistance at 0.7612.

Support levels - 0.7538 (cloud base), 0.7502 (200-DMA), 0.7475 (Mar 27 low), 0.7435 (Nov 11, 2016 low)

Resistance levels - 0.7575 (5-DMA), 0.76, 0.7612 (20-DMA), 0.7634 (April 5 high)

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 0.7560, SL: 0.76, TP: 0.75/ 0.7475/ 0.7435

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -74.8668 (Bearish), while Hourly CHF Spot Index was at -82.2388 (Bearish) at 0920 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.