EURCHF’s bullish swings have been exhausted at 1.1264 levels yesterday, price plummeted below DMAs today, consequently, a stern bearish engulfing pattern candle has occurred at 1.1210 levels(refer daily chart). The current price (1.1210 levels) is sensing little overbought pressures. Bulls in the minor trend of the pair attempted to bounce back but has failed at around 1.1222 levels (i.e. 21-SMA).

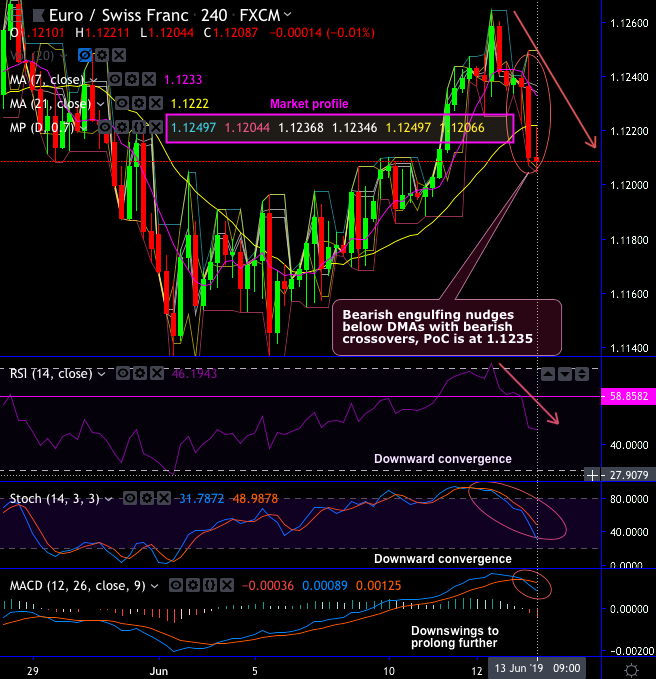

Market profile on 4H:

Point of control (PoC) is at 1.1235,

Unfair highs – 1.1250

Unfair lows – 1.1204

Value area (VA) – 1.1250 – 1.1206

21-SMA – 1.1222

7-DMA – 1.1233

RSI – Shows downward convergence that is indicating the strength in the prevailing downtrend. If the selling sentiments sustain, then the extension of slumps seem to be most likely. One shouldn’t be surprised by some more dips to stimulate the major downtrend.

Fast stochastic curves - %d crossover from the overbought zone is also signaling the intensified selling momentum.

To substantiate the bearish stance, the trend indicator shows bearish MACD crossovers to indicate the prevailing downtrend to prolong further.

On a broader perspective, the major trend resumes bearish swings on back-to-back shooting stars at 1.1358, 1.1384 and 1.1364 levels (refer monthly plotting).

Both leading oscillators RSI and stochastic curves indicate intensified bearish momentum, consequently, the current price slid below EMAs.

Trade Tips: Well, on trading perspective, at spot reference: 1.1206 levels, it is advisable to one-touch put option spread using lower strikes at 1.1160 levels. The strategy is likely to fetch leveraged yields as long as the underlying spot price remains between above strikes on the expiration.

Alternatively, on hedging grounds, we advocate initiating shorts in EURCHF futures contracts of June’19 delivery. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -23 levels (which is mildly bearish), while hourly CHF spot index was at 26 (mildly bullish) while articulating (at 11:27 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex