Well, in our previous write-up we’ve advocated AUDNZD credit call spread for both hedgers and speculators taking into account.

The strategy reads this way, short ITM calls and OTM long calls with 2w and 1m expiries respectively.

Where theta on shorts is the sensitivity of an option’s value to the passage of time.

It is usually expressed as the change in value per one day’s passage of time.

It can wipe a smile off the face of any determined trader once its insidious nature becomes fully felt.

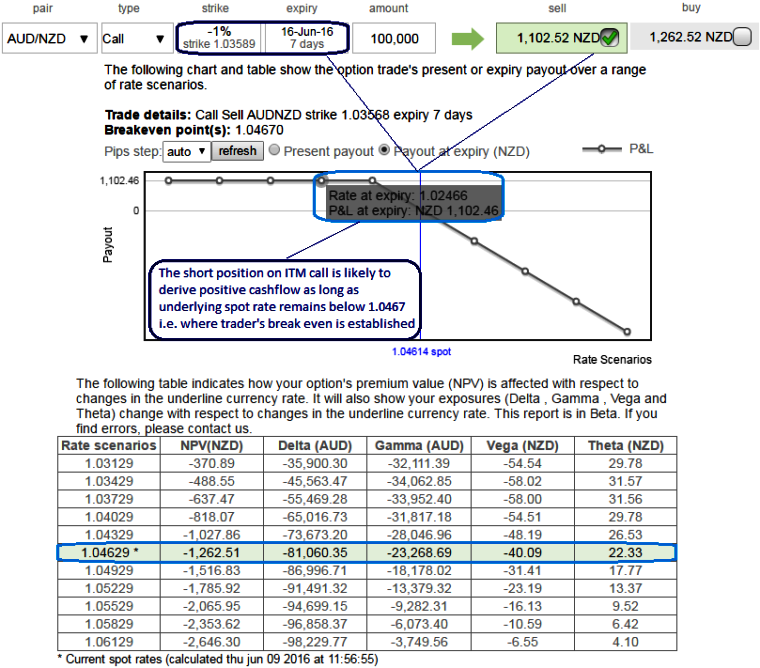

As you can observe from the above diagram that explains the various payoff graphs on corresponding shifts in strikes, option Greeks and NPV of short call position.

Please be noted that the theta at spot reference 1.0463 is 22.33, which means for every day NZD22.33 is likely to wipe off in the option's value even if underlying spot remains stagnant.

| Passage of time | Call premium value |

|---|---|

| At the time of execution of strategy | 1102.52 |

| Day 1 | 1080.19 |

| Day 2 | 1057.86 |

| Day 3 | 1035.53 |

| Day 4 | 1013.20 |

| Day 5 | 990.87 |

| Day 6 | 968.54 |

| On expiry | 946.21 |

In the below nutshell, we’ve also demonstrated how theta reacts to the time decay and their effects on option premiums. Remember, we’ve assumed the scenario where underlying spot remains stagnant.

Theta is not a constant, it changes as the underlying market moves and time passes.

You can also observe the increase in theta when underlying spot drifts below the current 1.0463 levels in sensitivity table, thereby more reduction in option value.

Moreover, chances of exercising option rights are very minimal when the spot rate is declined.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms