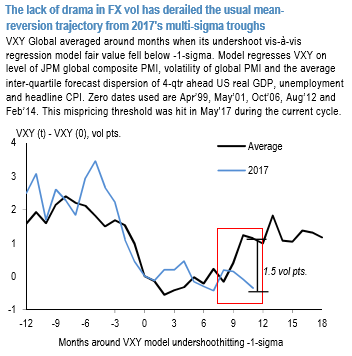

FX vols steered another week of tepid price action seemingly bulletproof to any and all shocks ranging from trade sanctions to a blow-up in a heavily owned large EM currency (Russia). VXY Global has now retraced three-quarters of its early-year rally up to the VIX shock peak and has once again begun to screen materially cheap (1-sigma) vis-a-vis business cycle drivers. The degree of misalignment is not unprecedented, but it is odd to see vols this depressed at such an advanced stage of the mean-reversion cycle after hitting 2017's multi-sigma trough last May (refer 1st chart).

One could argue that the underpricing of FX vol simply mirrors the dollar’s disconnect from rate differentials, which in turn is a product of twin deficit concerns spawned by a unique bout fiscal expansion near the top of the cycle.

The fate of FX vol has historically been intimately intertwined with that of the dollar given its status as the world’s pre-eminent funding currency, a durable cyclical discount in the latter can, therefore, lead to a persistent cap on the former.

Macro triggers such as a spike in US inflation that abruptly pulls forward Fed hikes can derail the current happy equilibrium; till (or if) they arrive, option investors will have to rely on the tough slog of actively delta-hedging micro noise to cover decay bills, for which long gamma is proving a better vehicle than Vega (refer 2nd chart). Vol curves have also steepened recently to levels (average 1Y -1M ATM slope across US pairs 1%pt.) that, while not extreme, makes shorter-expiry options easier to hold. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise