Global trade headwinds are suddenly gusting stronger and pose distinctly-negative risks to CAD. Despite the seminal shift in monetary policy, CA rate spreads have actually compressed somewhat since the BoC meeting, following concerns on US inflation and global trade.

Furthermore, Canada remains distinct in that it not only faces adverse consequences from a US-China fallout but is exposed to trade risk on the North American front as well. We’ve long been documenting the risks surrounding USMCA / NAFTA 2.0 ratification, with a particular emphasis on bipartisan divide which risks triggering a NAFTA 1.0 pull-out.

Canada’s trade balance shifted to CAD 0.76 billion surplus in May 2019 from an upwardly revised CAD 1.08 billion in the previous month and compared with market expectations of a CAD 1.5 billion gap. It was the second trade surplus since December 2016, as exports rose 4.6 percent to a record high driven by motor vehicles and imports increased at a slower 1 percent mainly due to aircraft. Exports to the US went up 3.7 percent to an all-time high of CAD 39.3 billion.

GBPCAD has been dipping from 1.7728 to the current 1.6443 levels on weekly terms, now slid way below 21DMAs. Overall, the major downtrend is now resumed again with more downside traction in the days to come.

OTC Updates and Options Strategy:

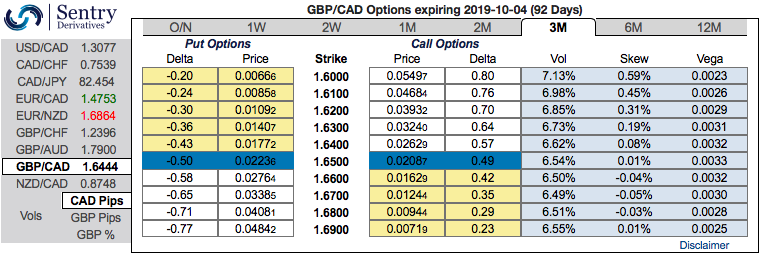

The positively skewed GBPCAD IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 1.60 levels indicating downside risks in the medium terms (refer 1stchart). Please observe above technical chart for the major downtrend.

Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of a customized version of options combination and more bearish version of the common straddle.

Attractive returns are achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards -81 levels (which is highly bearish), GBP is at 72 (bullish), while articulating (at 08:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure