The weakness in Asian markets is likely to filter through to other markets as investors digest China’s downwardly-revised growth target setting risk assets on the back foot. In addition, the US Trade Representative office announced that India and Turkey no longer qualified as beneficiary developing countries under Washington’s Generalized System of Preferences (GSP). The GSP provides low-income and emerging economies with duty-free access to the US market for some of their exports. This is likely to stoke trade tensions and weigh on emerging-market currencies.

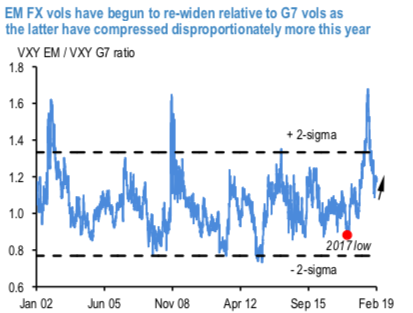

An odd by-product of the nosedive in G7 vol has emerged: EM vs. G7 vol spreads are re-widening, not because risk premia in EM are rising as was the case last year – quite the opposite in fact – but because G7 options have cheapened disproportionately more (refer 1st chart).

Rewards from outright vol selling are absolute, not relative quantities, yet this comparative EM – G7 vol set-up is motivating many to consider short EM FX vol plays as a complement to long carry portfolios. One cannot argue with a theme that is so manifestly working – 2nd chart exhibits that traditional high-beta EM names like TRY, MXN and KRW led the short vol league tables in February with sizeable 1.5 – 3.0 % pt. P/Ls, in contrast to mild losses from selling AUD and NZD vol where central bank and data-driven spot gyrations were more acute.

We ourselves are running short TRY and MXN vol in our model portfolio in more cautious formats than outright straddles (TRY – ratio USD put/TRY call spreads; MXN – calendar risk-reversals). TRY in particular offers above-average vol risk premium to monetize (1M ATM 13.0 vs. trailing 1m realized vol 8.0); we think implied vols are being kept artificially elevated by macro demand for directional carry- earning purchased option structures (USD puts/put spreads/digitals), but the historical track records of cash FX carry versus vol carry in the lira are so starkly divergent (refer 3rd chart) that we think levered money will be drawn to the latter sooner or later, which in turn should pressure vol lower.

In terms of the rest of our USD/Asia profile, the revised CNY outlook shifts other EM Asia currencies higher, particularly in the second half of 2019. However, the broad pattern of current account surplus currencies outperforming those with current account deficits is maintained. Courtesy: RMB & JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -129 levels (which is highly bearish), hourly USD spot index was at 103 (highly bullish), EUR is at -55 (bearish) and GBP is at -64 (bearish) while articulating at (08:22 GMT). These indices are indicating the CAD’s softness against majors.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?