The British pound remains under pressure, as markets focus on Brexit and political headlines in the absence of key data releases today.

EURGBP has been oscillating between a tight range of 0.8994 – 0.8282 levels, but the major trend remains puzzling even though bearish bias in the minor trend.

BoE Governor Carney’s testimony to the Treasury Select Committee on the May Inflation Report, originally scheduled for today, has been postponed. A new date has yet to be announced. In the meantime, market focus on Brexit and domestic political headlines will continue, while today’s CBI industrial trends survey will probably attract limited attention.

In light of PM May’s proposal at the weekend for a ‘new and improved’ Brexit offer to Parliament, the Cabinet is expected to discuss making the deal more attractive to Labour MPs in a bid to help pass the Withdrawal Agreement Bill in early June.

In Europe, ECB Vice President Guindos and Bank of Italy Governor Visco are scheduled to speak, although it’s not clear how much they will elaborate on monetary policy. More attention will be on tomorrow’s ECB ‘colloquium’ which will include a welcome address from President Draghi.

Well, ahead of these events, let’s just quickly glance at OTC outlook before looking at the options strategies.

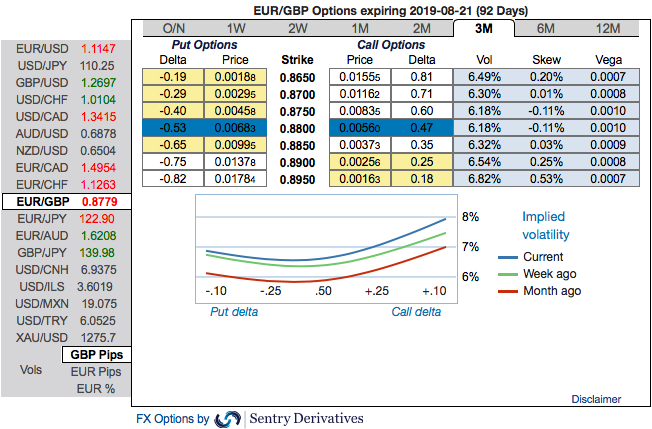

Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term, while the pair displays 6.49-6.82% of IVs.

While positively skewed IVs of EURGBP has been balanced on either side, bids for both OTM calls and OTM puts. This is conducive for options holders of both OTM call and put options.

A key rate change since the last meeting on 21 March is that the risk of an imminent ‘no deal’ Brexit has been averted. Paradoxically, it is that uncertainty which may have led to increased stockpiling, providing a boost to economic activity in Q1.

The BoE’s near-term CPI inflation forecast is likely to be revised up as a result of higher energy prices, while the over the medium-term it is projected to remain above target, with limited spare capacity pushing up domestic price pressures. That calls for UK interest rates to rise over the forecast horizon. However, the ‘fog of Brexit’ suggests policymakers will remain patient.

You see any fresh positive bids in EURGBP risk reversals to the existing bullish setup, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

3-way options straddle versus ITM calls seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -5 levels (which is neutral), while hourly GBP spot index was at -74 (bearish) while articulating (at 12:05 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure