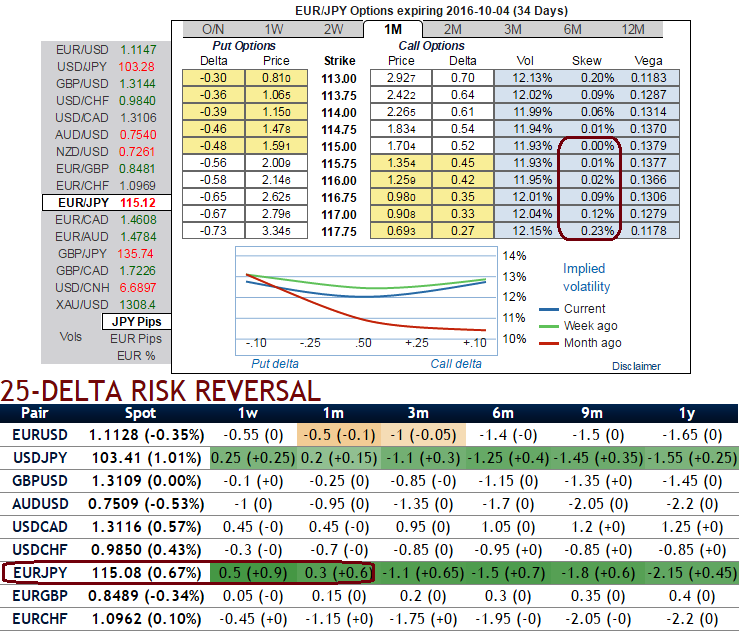

As the EURJPY delta risk reversal pops up with bullish interests as the progressive increase in positive numbers signify the traction for hedging sentiments for upside risks in 1-month tenor.

While IVs of ATM contracts of 1m tenors are spiking crazily above 12% and this has been justified by historical volatilities in spot FX fluctuations (we observed almost 2.06% spike in spot rates in last week).

1m ATM IVs have been positively skewed towards OTM calls strikes which would mean that the interest in calls are on higher demand, and hence, these instruments are being more expensive than puts (upside protection on the underlying forex spot is relatively more expensive).

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract keeps rising and when the short-term trend is bearish, spikes in previous rallies for a short term which is the good sign for option holders.

Amid the apprehensions on perimeters of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long-term hedging but by capitalizing on every short-term upswing, preferably via options during upcoming ECB meetings.

Technically, since the bulls have managed to break out resistance above 114.848 levels recently, the rallies may drag further up to next resistance of 116.537, RSI has been positively converging to the upswings.

Current prices have jumped above DMAs with 7DMA crossing over 21DMA and MACD has evidenced bullish crossover, this would mean that bulls wings may prolong further. Hence, we think that 1m IVs are moving in sync with risk reversals.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics