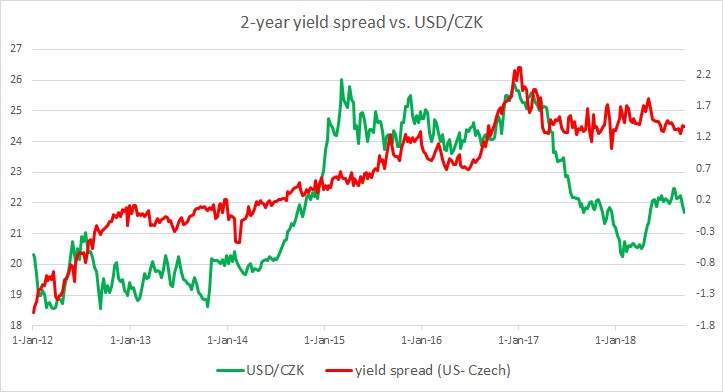

The chart above shows, how the relationship between USD/CZK and 2-year yield spread has unfolded since 2012.

Brief background:

- It can be seen even with a naked eye, that the pair and the yield spread between 2-year treasury and 2-year Czech government bond have enjoyed a fairly close relationship.

- The Czech National Bank (CNB) began reducing interest rates in the aftermath of the ‘Great Recession’ of 2008/09. The interest rates declined steadily from 375 basis points in 2008 to just 75 basis points in 2010.

- The interest rates were reduced again in the aftermath of the Eurozone debt crisis. In 2012, CNB reduced rates from 75 basis points to just 0.05 basis points and it remained at the level until recently.

- In addition to that, in 2013, CNB pegged Czech Koruna with the Euro at 27 per euro.

- It can be seen from the chart as CNB started reducing rates again in 2012 and maintained dovish tone, while the US Federal Reserve indicated that it is going to wind up its asset purchases, the 2-year yield spread widened in favor of the dollar and the exchange rate declined from 19 per dollar to 26 per dollar.

- However, there have been changes in tone in CNB communications since 2016 and the central bank has hiked five times since H2 2017.

Past Reviews:

- In our in August, we noted that the exchange rate and the spread have responded accordingly. Koruna has strengthened from 26 per dollar to 22 per dollar, while yield spread declined from 232 basis points in January to 134 basis points. We suggested that the expectations of a change in CNB policies as well as a rebound in Eurozone economies to be playing parts. However, we also noted that the exchange rate has moved much faster than the spread, which is unlikely to be sustained in the medium term.

- In our last review in early October, we noted that the spread has narrowed by around 7 basis points in favor of the Czech Koruna, while the Koruna has declined by 13 pips, thus reducing the divergence to some extent.

- In our late October review, we noted that the spread hasn’t changed much since our last review and was at 127 bps and Koruna has also remained flat, which was then trading at 22.05 per dollar.

- In our review in December, we noted that while CNB has increased interest rate by 25 bps to 50 bps, the spread has widened by 12 bps to 139 bps in favor of the USD and the exchange rate declined from 22.05 per USD to 21.74 per USD, thus increasing the divergence.

- In our February review, we noted that CNB has raised the rates again in January, making it thrice since July. The spread, however, has further widened to 165 bps in favor of the USD but the Czech Koruna strengthened from 21.74 per USD to 20.8 per USD.

- In our April review, we saw that the spread narrowed by 7 bps to 159 bps in favor of the Czech Koruna which responded accordingly by strengthening from 20.8 to 20.53 per dollar.

- In May 2018 we saw, the spread has widened sharply by 13 bps to 172 bps in favor of the dollar, and Czech Koruna responded accordingly by weakening from 20.53 per dollar to 21.4 per dollar.

- In July, we noted that the spread declined from 182 bps to 149 bps in favor of the Koruna and but it weakened from 21.34 to 22.06 per USD.

- CNB has raised rates again in June and in August by 25 basis points each pushing the rates to 1.25 percent.

Analysis:

The spread has been declining in favor of the Czech Koruna, however, as expected, the Koruna weakened against the USD, as the divergence that has taken place in 2017 has been very large still. In August, the spread has further narrowed to 133 bps but the Koruna weakened further to 22.23 per USD.

The trend has slightly reversed in September. The spread widened from 133 bps to 137 bps, and Czech Koruna strengthened to 21.69 per USD.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX