Global reflation is thought to be one of the factors potential to bring down the economy and the bull market that is continuing for an eighth consecutive year. Especially since 2016, global reflation has emerged many a time in reports and articles published by analysts including us. Speaking recently, Fed Chair Janet Yellen expressed confidence that inflation will reach the target by next year, while German Bundesbank, as usual, kept issuing warnings against inflation throughout the year.

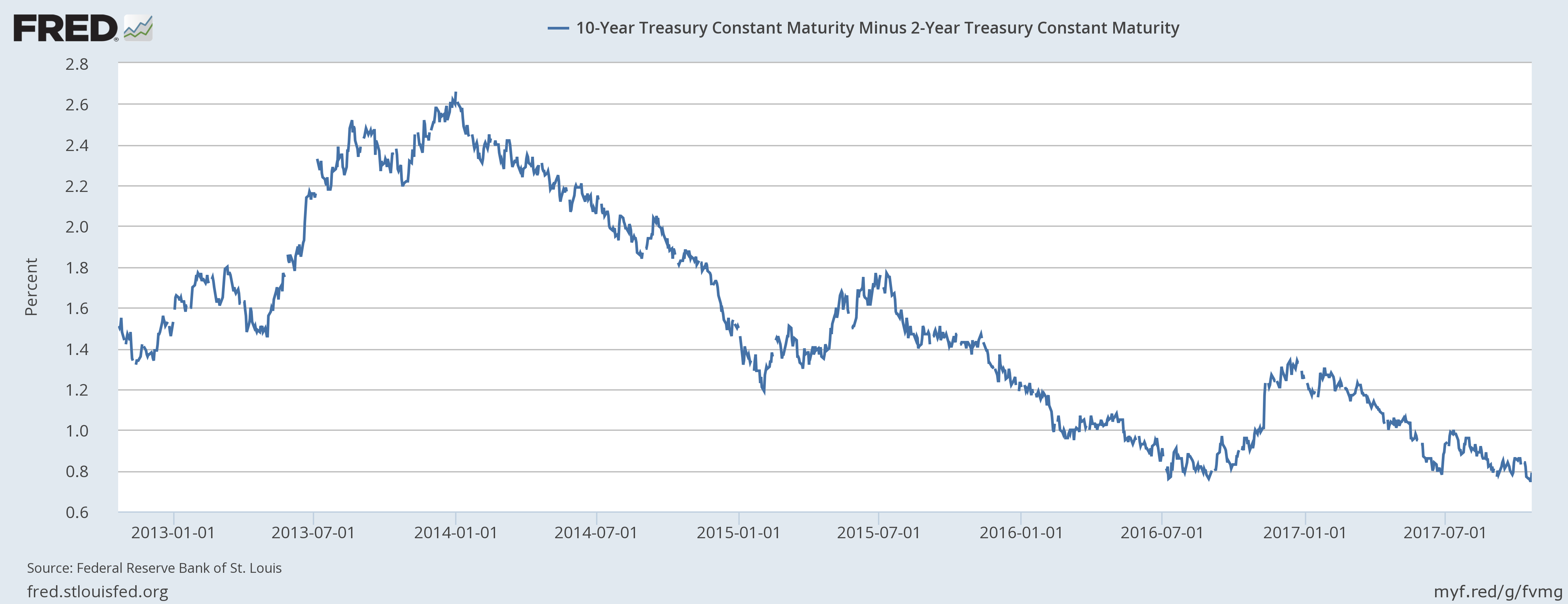

But, the U.S. bond market doesn’t seem to be worried about the threats of reflation. These charts show the inflation compensation demanded by the market remains low, while the U.S. yield curve continues to flatten.

Chart 1: Chart shows that the spread between U.S. 2-year bond and 30-year bond has declined to just 126 basis points, which is the lowest since the Great Recession.

Chart 2: Chart shows that the spread between U.S. 2-year bond and 10-year bond has declined to just 75 basis points, which is the lowest since the Great Recession.

Chart 3: The chart shows the 5-year, 5-year forward inflation expectation at 198 basis points, around 100 basis points lower than the post-crisis peak.

Chart 4: This chart shows the 10-year breakeven inflation rate at 188 basis points, which is around 80 basis points lower than its post-crisis peak.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality