GBP NEER has been locked into an exceptionally tight range, not so much because of an absence of developments, especially on the Brexit front, more that investors just don't know what to make of these, either for the end-game to Brexit or the remainder of the process.

Bearish GBP scenario:

1) A no-deal Brexit.

2) The BoE passes in Aug, possibly due to political turmoil.

3) May is challenged and replaced by a hard-Brexiteer.

4) The overt balance of payments pressure.

Bullish GBP scenario:

1) The EU compromises over the UK’s Brexit proposals,

2) An extension to the Article 50 process that allows the UK to reconsider its decision to leave;

3) May sees down a leadership challenge;

4) Parliament rejects the withdrawal deal, eventually, a 2nd referendum is held.

Please be noted that the positively skewed IVs of 1m tenors of this pair signifies bearish risks, technical trend (for both minor & major trends, refer above technical charts) and above stated fundamental driving forces of this pair have been indicating perplexities which means hedgers’ sentiments of this pair may head towards any directions with more potential on downside in near term.

The lack of volatility in GBP together with the lack of visibility around Brexit mean that we’re neither forced nor inclined to change the GBP forecasts this month -these envisage modest near-term weakness in GBP vs CAD. The UK government finally published its proposals for its future relationship with the EU following a cabinet showdown that resulted in the resignation of two pro-Brexit ministers resigning (the foreign secretary Johnson and the Brexit secretary Davis). The white paper targets a free trade area in goods based on a harmonized rulebook (the UK mirroring EU standards) and a 'facilitated customs arrangement'.

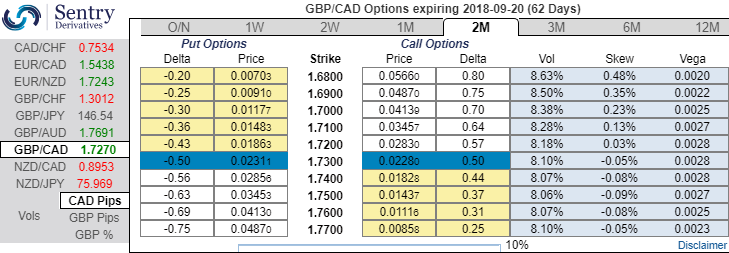

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.7264, initiate long in 1M GBPCAD at the money +0.51 delta call, add one more lot of 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost.

Currency Strength Index: FxWirePro's hourly GBP spot index is at shy above -86 levels (which is bearish), while hourly CAD spot index is edging higher at -104 levels (bearish) while articulating (at 12:13 GMT). For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data