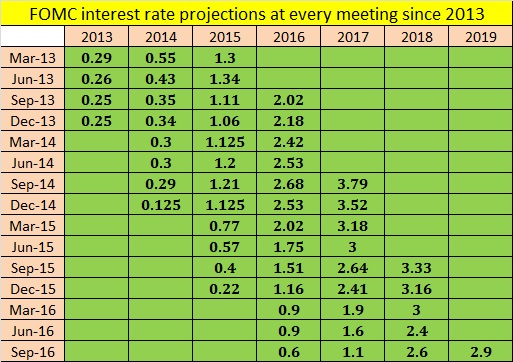

The above figure represents FOMC interest rate projections since 2013 and we would try to assess today’s meeting from the past projections.

First of all, a rate hike is completely priced in and the financial markets are certain of a rate hike today. Unless FOMC announces no rate cut there could hardly be any surprise to that. So any hawkish or dovish signal should come from the projections of future hikes.

- Let’s take a look at the last projection, which was in September this year. According to the material, FOMC projected 0.6 percent interest rate for 2016, 1.1 percent for 2017, and 2.6 percent for 2018. If FOMC hikes rates today, the new Fed rate would be 0.625 percent or between 0.5 to 0.75 percent. So as of September, FOMC was projecting two rate hikes for 2017 and three for 2018 and each of 25 basis points.

- So, for the FOMC to be hawkish these projections need to move higher by at least 25 basis points and preferably it should by 50 basis points.

- Another important point to note from the projection material is the fact that the very last time the projected interest rates were higher than the previous meeting was back in September 2014. So the Fed hasn’t been a hawk in a very long time. Back in September 2014, FOMC projected interest rates of 2.7 percent for 2016 and 3.8 percent for 2017. In reality, the interest for this year would be no more than 0.625 percent and 2017 is unlikely to be more than 1.625 percent.

- The hike would likely to be a dovish one in sentiment if the policymakers keep the projections same as at September.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist