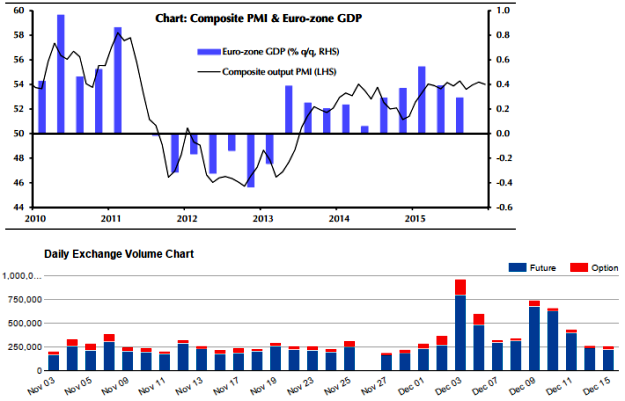

The fall in the headline euro-zone Composite PMI, from 54.2 to 54.0, was a little worse than the consensus forecast of no change but it did not fully reverse last month's increase.

The fall in the euro-zone Composite PMI in December kept it still pointing to steady but modest growth in the region.

The index which measures the combined output of both the manufacturing and service sectors eased down from 54.2 in November to 54.0 in December, below projections for 54.2.

But the Paris attacks have taken a toll on France, leaving the economy close to stagnation again.

Based on its past relationship with quarterly GDP growth, the PMI points to an expansion of about 0.4% in Q4. (See Chart.)

This would be better than Q3's 0.3% increase and in line with the Q2 outturn, although note that the PMI over-predicted growth in the third quarter.

The limited country breakdown showed falls in the Composite PMIs for both Germany and France.

We keep urging often and often with spot FX flashes of EURUSD at 1.0925 delta risk reversal for 1 week contracts have shown bearish signals back again and long term (1M-1Y) put contracts are also on higher demand.

Please be informed that comparison between risk reversal from last week to the current situations.

More importantly, the contracts of this pair for 3m-1y expiries show gradual increase in negative sentiments.

So, from this computation what we could read is that EUR may gain until Fed's rate decision and thereafter we could foresee dollar's appreciation as quite certain event.

See how the OTC volumes are shrinking as the recent prices rallies in EURUSD.

The interpretation contemplating all above factors would divulge the right direction of EURUSD, yes, enough of speculation with EURUSD and stay hedged fairly priced derivative instruments as euros depreciation is on cards.

Eurozone PMI devastating fragile EUR/USD ahead of Fed, OTC volumes almost factor-in Fed decision

Wednesday, December 16, 2015 1:27 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?