How much would you think that rate and FX liquidity worsen as the bond market sell-off extends?

The huge European bond selloff in 2015 so far that has already wiped out $300 billion from the market, according to options prices on German bond futures.

The brief answer has been mystified since the regulatory environment that has contributed to these conditions is unprecedented.

The premium for puts over calls on what is Europe's bond bellwether shrunk last week to as little as 0.4% it was at 0.74%, the smallest on a closing basis since bunds and bund futures began their plunge. The spread was as high as 1.78% point on May 13.

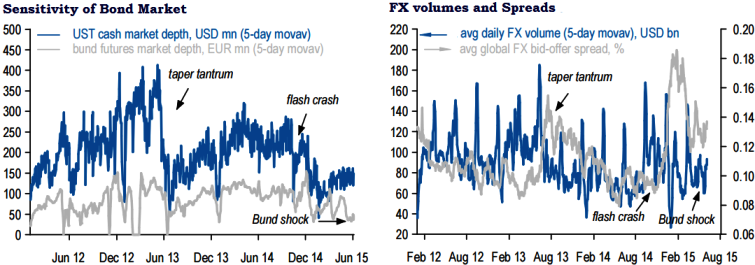

Here are few things that matter FX markets: VaR (Value at Risk) shocks are occurring more frequently; As shown in the 1st chart the bond market's performance in depth seems to decline during each of the episodes (policy changes); While second 2nd chart shows FX volumes sometimes rise and sometimes fall during these shocks.

FX bid-off spreads almost always widen in 2nd chart.

So what could be the genuine reason for such movements..?

Yes indeed, the reaction is to somewhat modest inflection points in data or central bank policy, liquidity conditions seem biased to worsen much more during a policy process like Fed tightening that could run for a year or more.

European Bond’s uproar seems to matter much on derivatives markets

Tuesday, June 9, 2015 7:19 AM UTC

Editor's Picks

- Market Data

Most Popular

3

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?