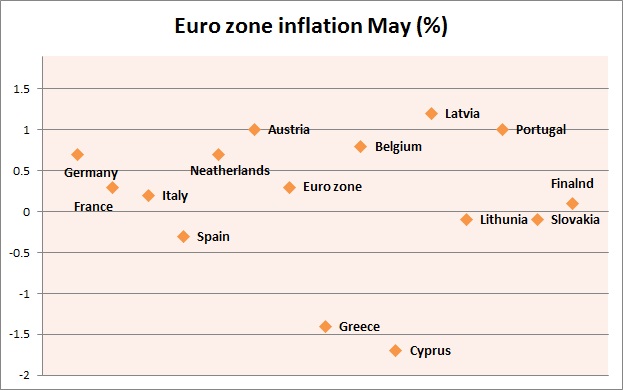

Today Eurozone CPI estimate was released by Euro stat and that showed inflation in Euro remains in positive but subdued.

- Diverse growth and inflation in European Monetary Union (EMU) makes it harder for European Central Bank to conduct monetary policies. While growth has bounced back strongly in Spain, Italy, and Portugal countries like Cyprus, Greece remains in deep recession.

- Similarly inflationary report from Euro stat for May month showed, while countries like Austria, Netherlands, Germany experience positive inflation, Countries like Cyprus, Greece, Slovakia remains in deflated territory.

While ebbing deflationary fear, provided support for the initial rally in European bond market, second phase of support was provided by fear over Greek contagion.

However yield bulls remain at risk, in the face of ECB purchasing government bonds, if Greek situation subsides. As of now, overall inflation remains too weak to spur any massive rout in bond market.

- Euro zone inflation was supported by price rise in Vegetables, Tobacco, restaurant and Cafes. These volatile components are unlikely to spur stabilized positive inflation.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand