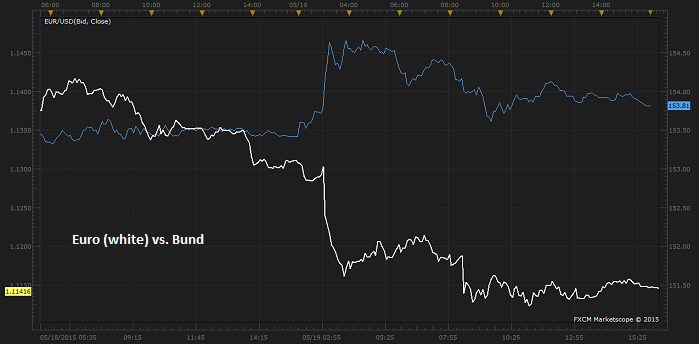

Yesterday commentary from ECB official Mr. Coeure had hit Euro the hardest, souring the recent bull trend in Euro.

- For the month of May and June, ECB will be frontloading asset purchase which means ECB will be buying more bonds while adjusting it for later. Moreover ECB stands ready to increase pace of purchase or extend the purchase target if required.

This statement created havoc for Euro which fell from 1.1325 to 1.109 as of now against dollar.

However German bund yield is showing resilience.

- At one point 10 year bund yield was trading at 0.56%, however recovered loss sharply and traded as high as 0.64% and settling finally around 0.61% yesterday.

Today, Bund has opened with a gap currently trading at 154. Euro loss will sharpen if bund yields get back on their downward trajectory.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary