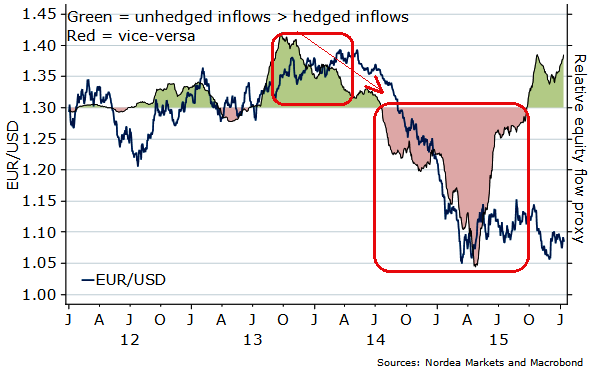

The landscape of EURUSD FX markets are constantly changing, particularly in relation with investment inflows: The keen observation is that EURUSD downtrend followed the moment when unhedged equity inflows into the EUR began way back in mid-2013 (see upper rectangular portion) but hedged inflow in 2014 have shown us the impetus of bearish trend that the pair has evidenced so far.

But the recent equity inflows into the EUR have remained largely unhedged despite the fact that the noteworthy monetary policies from both sides Fed and ECB that is again signaling and providing flow tailwinds for the EUR.

The challenges associated with the pair pop up some questions: Why do you think this economic phenomenon cushions euro? Does EURUSD characterize a topsy-turvy in terms of how to think about FX hedging strategies, and what are the quant and macro influences in 2016 & so on?

In mid-2014, the wise idea was apprehended and stroked investors' minds that it was a good idea to progressively hedge any FX exposures of EURO equity purchases. The Fed was not only going to stop its QE3 program, it was also going to hike the policy rate and eventually start "unprinting" money (Quantitative tightening).

While on the contrary ECB was taking up adverse decisions. Likewise, investors in SEK wanted to leave their USD exposures naked. Simultaneously, hedge ratios of current equity holdings were adjusted for the same reasons.

Equity flows into EUR have however recently turned largely unhedged and have thus become positive sentiments for spot EURUSD atleast in the short to medium run in a way they were not over large parts of 2014 and 2015.

The latter progressive attributes effects in a valuation perspective. EURUSD is around 10% below its post-1973 average of 1.18, and USDSEK is 15% higher than usual since 1994.

The dollar investors who trust in long-term mean-reversion should leave their EUR equity exposure increasingly unhedged, while e.g. EUR or SEK-based investors should hedge more of their USD equity exposure.

Additionally, please be noted that the earlier +ve correlation between EURUSD and stocks has retreated. Earlier, a EUR or SEK-based investor buying USD equities found a "cushion" in the form of higher returns in local currency due to the USD gaining if stock markets weakened.

This correlation change may reflect the long-term undervaluation of the EUR and the SEK, but is suggestive of changes to hedging policies.

Euro equity inflows shift gears of EUR/USD's bearish trend into deceleration pace, can unhedged proportion in 2016 topsy-turvy for FX rate?

Monday, January 18, 2016 7:48 AM UTC

Editor's Picks

- Market Data

Most Popular