Barclays notes:

Headline risks in Europe have decreased with Greece falling gradually off the radar for now. However, we believe the current macro and supply/demand outlook remains supportive of duration. Therefore, we maintain our long outright 10y Bund and 5y5y fwd Italy views, as well as our long Bund ASW versus EONIA trade in the near term. In money markets, we maintain our long ERZ6 outright or versus ERU5 recommendation.

This week was relatively quiet in the euro area. Greece made payments to the IMF and the ECB on Monday and passed the reform bill in the parliament on Wednesday. Formal negotiations for the third bailout should start very soon. The Financial Times reported that the new bailout is expected to be agreed in August, potentially ahead of the ECB redemptions on 20 August (€3.1bn). If the negotiations are not finalised by then, a new bridge financing will have to be arranged, likely similar to the most recent €7bn EFSM financing. The bottom line is that developments in Greece are unlikely to be market-moving in nature over the coming weeks absent an unexpected break-up of the talks.

Elsewhere, BoE July minutes released this week were somewhat hawkish with some members not voting for a hike just because of the Greek uncertainty, which is largely reduced in the short term at the least. On the week, risky assets were down slightly and commodities remained weak, which helped the rates market rally in a broadly quiet data week. 10y Bunds, Treasuries and Gilts yields have all fallen by about 5bp.

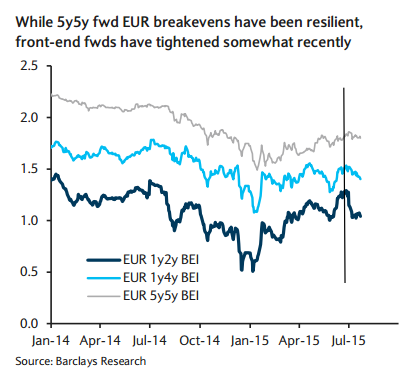

The key event for next week will be the FOMC meeting, with the market focus increasingly on whether the Fed will deliver the first hike in September. As our US colleagues argue, any notable Fed signalling towards a September hike might support the longer end of the Treasury curve. This, together with a vulnerable commodities outlook, makes us believe that duration resilience is likely to stay near-term for EUR rates. In addition, while 5y5y fwd EUR breakevens have been rather resilient lately around 1.80% and are less sensitive to commodity price swings partly thanks to QE, front-end forwards have tightened 15-25bp over the past month. These should continue to keep the ECB's very dovish stance firmly in play.

Euro area rates: Weekly Review

Thursday, July 23, 2015 11:49 PM UTC

Editor's Picks

- Market Data

Most Popular