EUR/GBP has recovered around 3.3% since beginning of this month. With this move , the UK effective exchange rate was softened by approx 12% during the same time.

The outlook for BoE interest rate policy is tied to the exchange rate performance irreversibly. The EUR/GBP exchange rate seem to have greater weightage due to substantial trade flows in the Euro zone.

UK policy setters might have take a sigh of relief, may be for this reason, for the failure of EUR depreciation after the ECB's policy meeting last week. If there would be broader weakness in the euro, it might support to add strength to GBP, leading to further monetary tightening in UK.

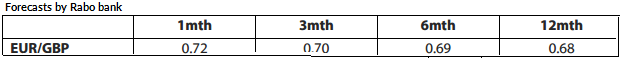

"On balance we do not expect the BoE to announce its first 25 bps rate hike of the cycle before August 2016. Although the Bank may not be in any rush to tighten, its first move is still likely to correspond to very easy policy settings at the ECB. Consequently we continue to expect EUR/GBP to continue to grind lower towards 0.68 on a 12 mth view", says Rabo bank in a research note.

EUR/GBP likely to continue to grind lower towards 0.68 in next year

Wednesday, December 9, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed