Even if pound sterling volatilities are not trading at historical highs, the FX options market is already heavily positioned upon the Brexit risk.

GBP/USD would fall more than the EUR/GBP would rise in a Brexit scenario. However, this does not imply that the optimal hedging solution is expressed in cable.

Ruthless downgrading UK growth projections would severely hamper sterling.

Capital outflows accelerated by a dismal investment outlook would worsen the UK's external position (the current account deficit has reached a record high of 5.1% of GDP) and fuel a negative GBP spiral, as the economy relies on capital inflows.

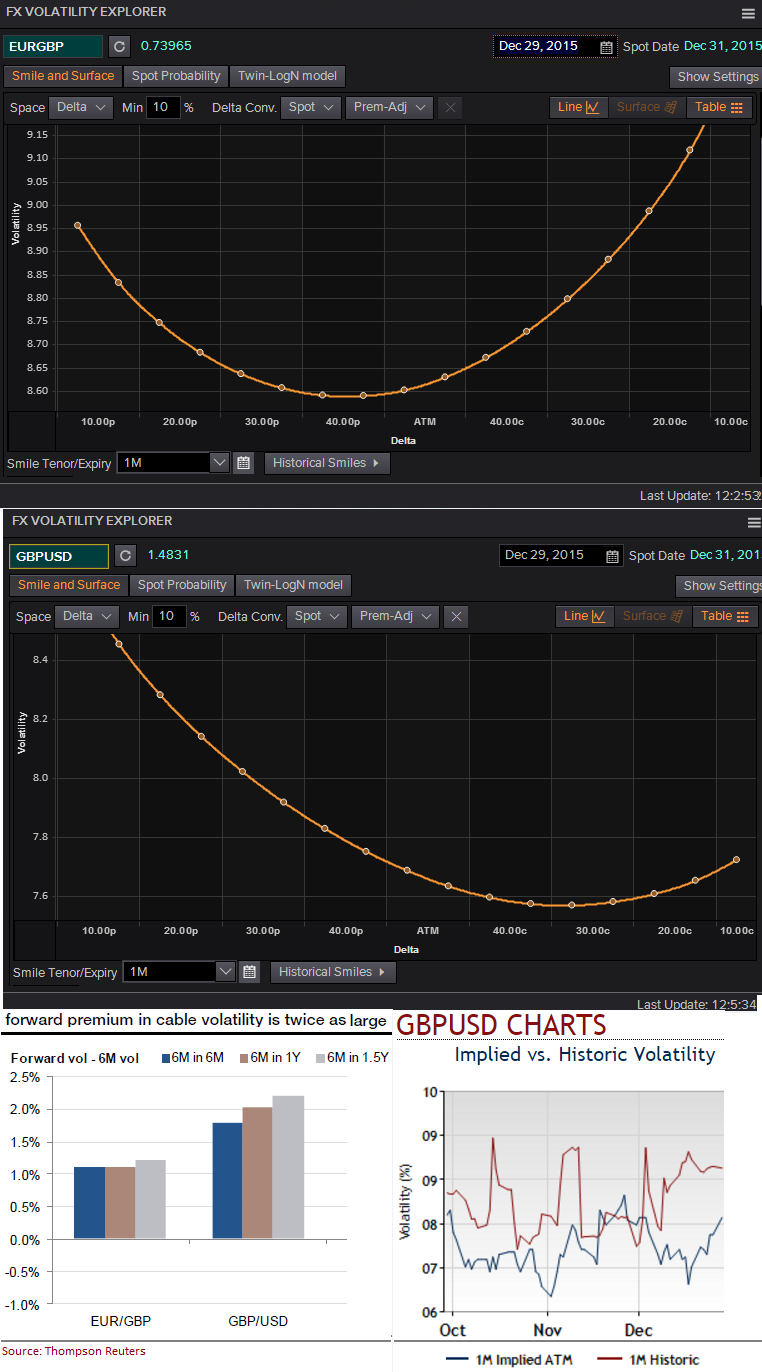

EUR/GBP volatility has been discounting a fair amount of euro risk since June, as it has been trading over cable since then.

This is a significant and seemingly lasting regime change, as cable volatility had been more expensive most of the time previously.

Nevertheless, counter-intuitively, the fact that EUR/GBP options currently integrate both European and UK risks makes them a more attractive hedge than cable options.

This is because the real cost of the hedge is reflected in the forward volatility, since the referendum will not be held before autumn 2016.

EUR/GBP/USD IVs, well positioned OTC and Brexit pressures in H1 2016

Tuesday, December 29, 2015 1:11 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?