United States’ Energy Information Administration (EIA) in its latest Crude Oil and Natural Gas Proved Reserves, Year-end 2015 report, which is available here, http://www.eia.gov/naturalgas/crudeoilreserves/ revised the proven oil and gas reserves in the United States lower.

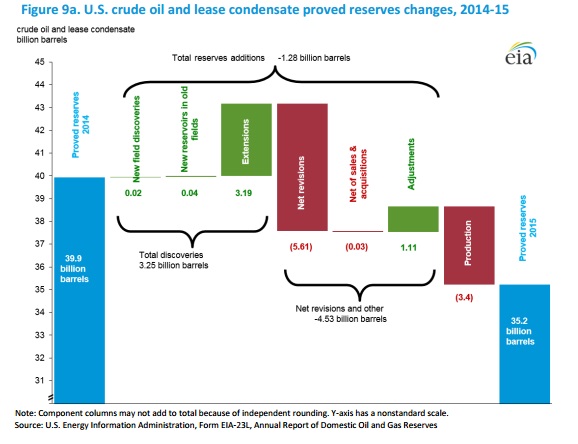

According to the report, between year-end 2014 and year-end 2015, U.S. crude oil and lease condensate proved reserves decreased from 39.9 billion barrels to 35.2 billion barrels, a decrease of 4.7 billion barrels (11.8%). Over the same period, proved reserves of U.S. total natural gas decreased by 64.5 trillion cubic feet (Tcf) (16.6%), declining from 388.8 Tcf in 2014.

The key factor that played here is the price. The average price of oil in 2015 dropped 47 percent compared to 2014, causing operators to postpone or cancel development plans and revise their proved reserves of crude oil and lease condensate downward. The average price of natural gas in 2015 dropped 42% compared to 2014, causing operators to revise their reserves downward, just as they did with oil.

This year, however, has so far proven to be much better for both oil and natural gas. The price of oil, after declining to $27 per barrel in February has jumped above $50 per barrel to end the year. The price of natural gas has more than doubled from the bottom around $1.6 per MMBtu in March. WTI is currently trading at $53.2 per barrel and natural gas $3.36 per MMBtu.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX