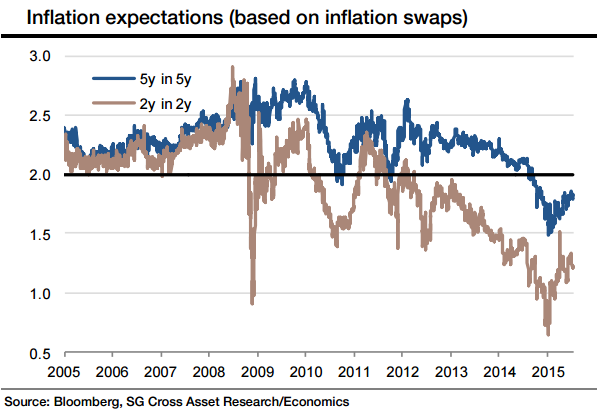

The ECB reiterated its dovish message, and neither recent events (Greece) nor macroeconomic developments (lower oil prices, China presumably) has altered the ECB's current assessment of the euro area economic recovery. The introductory statement reaffirmed that the €60bn/month QE programme is "intended to run until end-September 2016 and, in any case, until we see a sustained adjustment in the path of inflation that is consistent with the aim of achieving inflation rates below, but close to, 2% over the medium term". As in April, today's statement recalls the conditions for a more accommodative monetary policy: "If any factors were to lead to an unwarranted tightening of monetary policy, or if the outlook for price stability were to materially change, the Governing Council would respond to such a situation by using all the instruments available within its mandate.

Interestingly, the paragraph on the economic outlook included for the first time a mention of the slowdown in emerging countries. "However, the ongoing slowdown in emerging market economies continues to weigh on the global outlook and economic growth in the euro area is likely to continue to be dampened by the necessary balance sheet adjustments in a number of sectors and the sluggish pace of implementation of structural reforms". This is in line with the view that the contribution to euro area GDP growth from net exports is to be modest. Indeed, euro weakness will help exporters gain market share, but this gain will only partially offset the weakness in global trade.

The front-loading solution provides some flexibility for the ECB to address adverse market developments in the short term. Long term, the ECB could also seek to step-up QE from its €60bn pace, within the 25% issue limit and 33% issuer limit. But the ECB would need to point to a large increase in medium-term real interest rates, either through a lower inflation outlook or through an unwarranted increase in interest rates, which could result from external shocks (fed tightening) or from sizeable dislocations in euro area financial markets should the third Greek bailout fail.

"We have a lower long-term inflation forecast than the ECB, the fallout from the Greek situation and recent developments on Chinese equity markets are, so far, unlikely to materially lower our euro area inflation forecast," says Societe Generale.

ECB's monetary stance unchanged

Thursday, July 16, 2015 8:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX