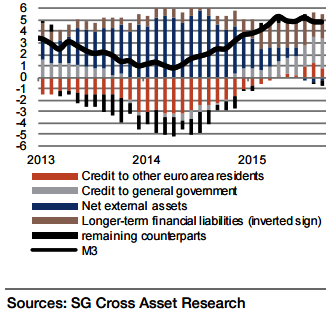

Euro area's Money supply growth for the month of September was 4.9% yoy, slightly below the expected 5% and modestly above August's 4.8%, the 3 month average was at 5%. The Money Supply growth on a 3-month average for October is expected to be at 4.9% on a consensus.

"We expect M3 money supply growth to have fallen to 4.8% yoy in October, with the risks to our forecast tilted to the downside", estimates Societe Generale.

There was a credit of all MFI's and buying of 37bn government bonds to the government from Eurosystem and the commercial banks were not showing any signs of their balance sheet increases, which was driving the money supply growth in September.

"Looking ahead, we expect yoy M3 growth to be in the 4.5-5.0% range over the coming months whereas the flow of credit to the private sector should accelerate", added Societe Generale.

EA's October Money supply growth likely to be 4.9% (yoy) and 5% (3M average)

Thursday, November 26, 2015 6:41 AM UTC

Editor's Picks

- Market Data

Most Popular

4

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022