Taiwan's central bank (CBC) is scheduled to review monetary policy this Thursday, immediately after the FOMC meeting. Market opinions are divided regarding whether the CBC will cut rates at a same time when the Fed is about to hike. The CBC could afford to go its own way on monetary policy, lowering the benchmark discount rate for the second time this year, by another 12.5bps. A policy divergence with the Fed may result in more capital outflows and more weakness in the TWD. But a strong current account will provide the cushion. And a weaker TWD can be tolerated, thanks to subdued inflation and low burdens on foreign debt.

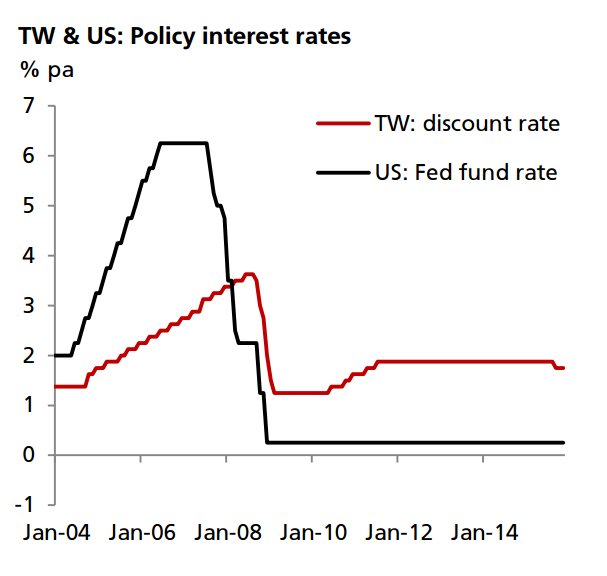

It was true that the CBC followed the Fed to hike rates during the 2004-07 cycle. Back then Taiwan's economic growth picked up along with rising demand from the US. Today's situation is different, as a slowing Chinese economy offsets the US's recovery and weighs on Taiwan's exports. In fact, the correlation with US growth cycle has weakened in recent years, and policy decoupling has taken place. The CBC continued to hike rates in 2007-08 when the Fed cut rates in the wake of the subprime crisis. The CBC also embarked a modest tightening cycle in 2010-11, even when the Fed continued to pursue quantitative easing.

In all, the CBC will focus on domestic economic fundamentals when deciding rates policy. On this front, exports continued to shrink sharply in Oct-Nov, industrial production moved sideways, and manufacturing PMI remained in contraction. Meanwhile, bank lending growth has remained subdued despite the CBC's last rate cut in Sep, consumer confidence continued to drop, wage growth slowed and the number of workers on unpaid leaves rose to a 3-year high. These suggest that the 4Q GDP will remain disappointing, the output gap will remain deeply negative and the outlook for recovery is elusive. Additional policy stimulus is needed to stabilize the short-term cycle.

Don’t underestimate the chance of a further rate cut in Taiwan

Monday, December 14, 2015 1:57 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan