Investor fear headed east in July from Greece to China. As Greece's avoidance of Grexit for now faded from the spotlight, markets instead focused on the steep sell-off in Chinese equities. Major Chinese indices are still up double digits year to date but that fact didn't stop investors from fearing the worst - a hard economic landing. When the Chinese markets were on fire, reaching new highs, there was nary an investor predicting a speed-up in the economy. Yet now that equities have come back to earth it of course must spell doom. Not really. China has been slowing down for quite some time as it tries to thread the needle of taming excesses while sidestepping a crash. When it comes to emerging markets, volatility is a given and should be expected.

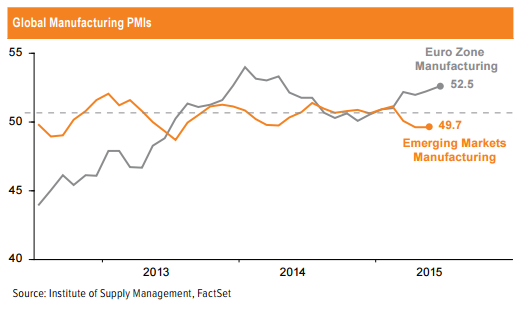

Developed markets have demonstrated awe-inspiring resilience in the face of struggles in China, Brazil, Puerto Rico and Greece. The U.S. economy and markets continue to march forward at a measured pace. The housing sector in particular is showing vigorous improvement, with existing home sales the fastest in eight years and rising to the highest median price on record. The employment front is also looking healthy; jobless claims have fallen to the lowest number since November 1973 and consistently have been below 300,000 since March. The latest U.S. and euro manufacturing reports indicate expansion while emerging markets are contracting slightly.

European and Japanese markets also demonstrated resilience, holding on to their strong gains year to date driven by expanding manufacturing and positive GDP. Their currencies also have stabilized relative to the U.S. dollar after sharp adjustments due to monetary stimulus from their respective central banks. As intensive energy exporters both regions are benefiting from lower energy prices, which are providing are a healthy dividend for consumers and businesses.

Developed countries are practically an oasis in the desert of the global economy. Emerging market currencies are plunging, especially Asian currencies such as the Malaysia ringgit, Indonesia rupiah, Thai baht and South Korean won; but also the currencies of commodity-intensive exporters such as Brazil, Canada, Australia and South Africa. Certainly the U.S. Federal Reserve (Fed) is creating some of these waves as result of ending its quantitative easing program and the likelihood of a near-term interest-rate hike, but the true culprit is China.

China's historic growth drove the commodity super cycle, and now its slowing growth is ending the super cycle through adverse impacts on Chinese exports, imports and investment spending. The world economy is struggling with a slowing China, but last year China was the biggest contributor to global growth, exceeding the United States. Its economy is the second largest in the world and nearly as big as all of Europe. It has four times the population of the United States. This may be why nearly every global firm is falling over itself, seeking to drive growth by locating and building in China.

China's government has clearly demonstrated that the nation is not ready to be a prime time market participant. Recent government interventions in the stock markets have done more to destroy China's future growth prospects than a summer sell-off would ever do. MSCI recently rejected China's A shares for inclusion into its MSCI Emerging Markets index, fortunately right before the July sell-off. The International Monetary Fund recently rejected China's yuan currency to be included for special drawing rights (SDR) - an exclusive collection of global currencies that form a special reserve asset. The SDR currently includes the U.S. dollar, euro, yen and pound sterling. China's aggressive intervention into its markets likely delays indefinitely these two important market-opening catalysts. These are minor but important examples of why the second largest economy in the world is still considered "emerging."

Developed markets resilient as emerging markets struggle

Thursday, August 6, 2015 11:11 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX