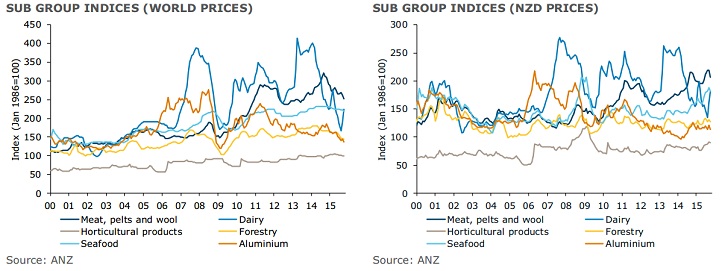

Latest report from ANZ shows, weaker New Zealand Dollar coupled with a rebound in dairy prices is providing some relief to the economy and its exporters.

- ANZ commodity price index, rose by 6.9% in October, second consecutive rise.

- Dairy prices, though down -10% from a year ago, moved up close to 18% in October. Whole milk powder led gains with rise by 26.2%, followed by skim milk powder (14.1%) and butter (7.8%).

- Weaker Kiwi is also providing support. Headline index price is 11.8% lower from last year's price but up 3.4% in New Zealand Dollar terms.

However non-dairy commodities are weighing on exporters. Non-dairy prices declined for sixth consecutive month.

- Price of non-dairy declined by -2.2% in October, down -9.3% from six months ago and -14.1% from a year ago.

Recent rise in New Zealand Dollar is however taking its toll.

- Due to past weakness in New Zealand Dollar, non-dairy prices are up 5.5% in last six months, in spite of more than -9% decline, but recent rise exacerbated pain as prices declined by -4.4% in New Zealand Dollar terms, double of what it actually would have been otherwise.

With report clearly showing the positive difference made by weaker New Zealand Dollar and persistent weakness in the sector, Reserve Bank of New Zealand is more likely to ease further than not.

New Zealand Dollar is currently trading at 0.673 against Dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand