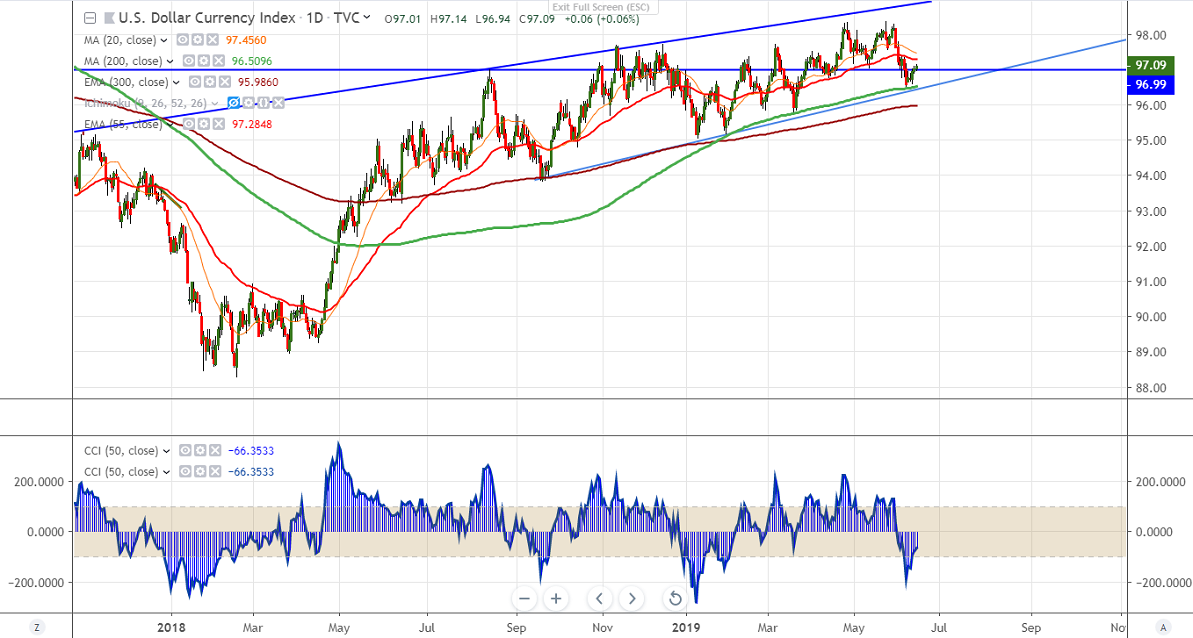

Major Support- 96.40-45 (trend line joining 93.84 and 95.16 and 200- day MA)

The US dollar index took support near trend line and shown a recovery of more than 50 pips. Short term trend is on the upside as the index is holding above 10-day MA. It hits intraday high of 97.14 and is currently trading around 97.08.

The index upside might be capped at 97.25 (50- day MA) and 97.45 (20- day MA)/97.66 (61.8% Fib). Any break above 97.66 targets 98.33 high made on Apr 26th 2019.6.14

On the flip side, trend line and 200 day MA at 96.40-4 will be acting as major support and daily close below 96.40 will drag the index down till 95.95.

It is good to buy on dips around 96.70-75 with SL around 96.40 for the TP of 97.40.