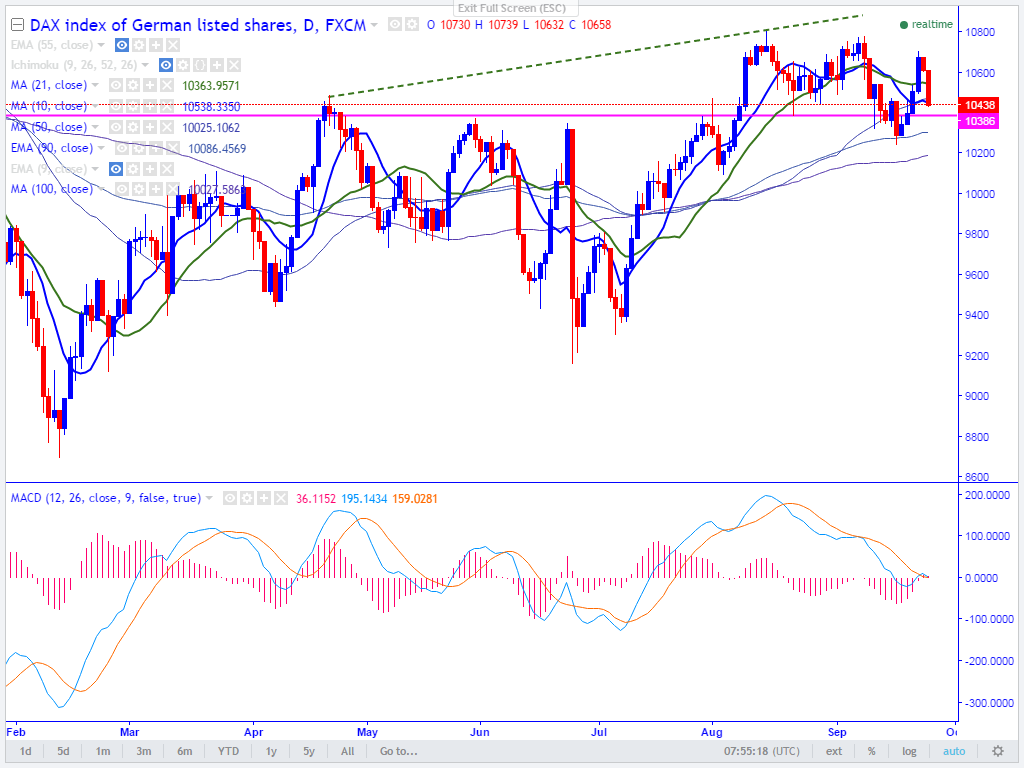

- Major resistance – 10806 (Aug 15th 2016 high).

- Major support – 10510 (daily Tenkan-Sen).

- The index has once again after making a high of 10707 on Sep 22nd 2016. It is currently trading around 10467.

- DAX30 has formed a temporary top around 10806 and any bullishness can be seen only above that level.

- In the daily chart, the index has broken daily Kijun-Sen and this indicated minor weakness , a decline till 10365/10200 is possible.

- Any break below 10510 (daily Tenkan-Sen) will drag the index down till 10365 (61.8% retracement of 10093 and 10806)/10244/10175 (100- day MA). The minor support is around 10650 (5-day MA).

- On the higher side, any break above10806 will take the index to next level till 10880/11020/11153 (161.8% retracement of 10806 and 10244).

It is good to buy on dips around 10600 with SL around 10450 for the TP of 10806/10878.