Dollar index trading at 95.91 (-0.45%)

Strength meter (today so far) – Euro +0.21%, Franc +0.02%, Yen -0.04%, GBP +0.80%

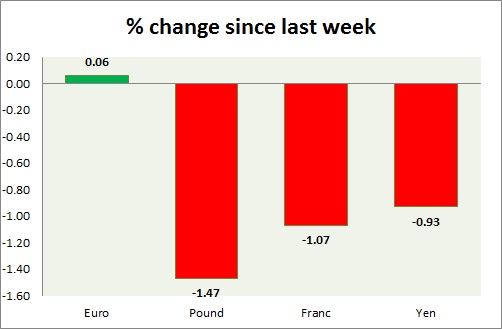

Strength meter (since last week) – Euro +0.06%, Franc -1.07%, Yen -0.93%, GBP -1.47%

EUR/USD –

Trading at 1.107

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.08, Medium term – 1.10, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.145, Short term – 1.12

Economic release today –

- NIL

Commentary –

- Euro is up today against the dollar, rising on risk affinity.

GBP/USD –

Trading at 1.333

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.25, Short term – 1.29

Resistance –

- Long term – 1.5, Medium term – 1.38, Short term – 1.35

Economic release today –

- NIL

Commentary –

- The pound has jumped higher trying to form a bottom around 1.3 area. However likely to face selling pressure ahead.

USD/JPY –

Trading at 102.3

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 100

Resistance –

- Long term – 111, Medium term – 107, Short term – 103.5

Economic release today –

- NIL

Commentary –

- Yen has lost more ground on rising equities. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 all targets reached, new target 90 added.

USD/CHF –

Trading at 0.98

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- NIL

Commentary –

- Due to SNB intervention, Franc is weaker performer this week. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX