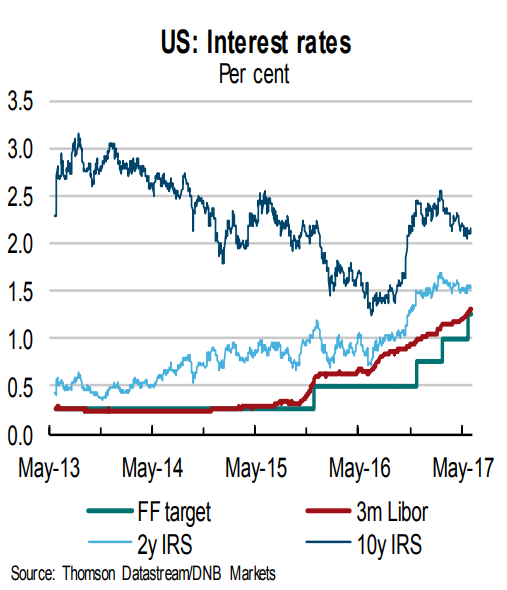

At its June policy meet, the US Federal Reserve delivered the expected hike and the Federal Open Market Committee (FOMC) presented a plan for reduction of the balance sheet. The overall macro-economic score and outlook for U.S. economy fell slightly in June. Core inflation has fallen and analysts expect that a continued undershoot of inflation target can force the Fed to hike less than indicated.

US core inflation has surprisingly fallen recently. Both PCE and CPI inflation fell in March and April, and core CPI also fell in May. Lower prices on wireless phone services was seen as the main drag. Q1 GDP was weak, growing by only 1.2 percent saar, in line with recent first quarter readings. However, ISMs and the Atlanta Fed’s GDPNow indicator both points at significantly higher growth in Q2.

However, the decline can be attributed to special factors and there is a risk of a continued undershoot of the inflation target. Two months of unexpectedly soft price readings have raised questions over whether the U.S. central bank will delay its plan to continue raising rates, after having hiked twice in the first half, including in June.

Fed's Mester, one of the Federal Reserve's more hawkish policymakers said last Friday that recent inflation weakness was likely temporary and it should not delay another interest-rate hike this year, even though there is no "immediate need" to tighten policy. With the U.S. economy at full employment and inflation set to hit the Federal Reserve's 2-percent target next year, the U.S. central bank needs to keep raising rates gradually to keep the economy on an even keel, San Francisco Fed President John Williams added last week.

"We adjust our forecast, and now expect the next hike to take place in December this year. We expect that the start of the reduction of the balance sheet will be announced at the September meeting," said DNB Bank in a report.

EUR/USD spike to hit fresh multi-month highs at 1.1435 after hawkish comments from European Central Bank president Mario Draghi. The pair has broken 1.1400 mark for first time in a year. Markets are also doubtful that Fed will hike in September due to weak economic data and also delay by Senate on health care vote. A break above 1.140 confirms major reversal, a jump till 1.1500/1.1546 level then likely. Short term bearish invalidation only below 1.1100.

FxWirePro's Hourly EUR Spot Index was at 24.3676 (Neutral), while Hourly USD Spot Index was at -50.5083 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest