China’s gross domestic product (GDP) is expected to further witness a solid outcome in the second quarter of this year, which should offer further crucial support to the global growth picture, according to the latest report from DBS Group Research.

Looking forward, continued recovery is further expected in industrial activities and infrastructure investment. According to Premier Li’s work report, RMB800 billion and RMB1.8 trillion will be invested in railway construction and road construction & waterway projects respectively this year.

Other investments include intercity transportation, utilities, civil & general aviation as well as next generation information infrastructure. Officials have approved a large number of projects since December 2018.

And issuance of local government (LG) bond intended to fund infrastructure spending soared in Q1’19 to RMB1.4 trillion, up significantly from RMB0.2 trillion in Q1’18. Front-loading of debt allocation alleviates fiscal stress faced by local government.

Local land sales, a primary source of LG funding, have come under pressure this year as the property market cools off. A VAT cut of up to Rmb2 trillion also depresses local tax revenues.

The PMI’s employment component of the nonmanufacturing sector – where the bulk of the workforce is employed – remained in the contractionary zone for seven consecutive months. Its manufacturing counterpart also hovered near the lowest level in 7 years.

Weak labour market and tepid income growth have dampened consumer sentiment. According to the PBoC’s Urban Depositor Survey, the proportion of respondents who intended to “save more” has, over a quarter, increased by 0.9ppt to 45 percent in Q1’19. Households were also less optimistic on the outlook for property prices.

Home-related expenditure from furniture to electric & video appliances may remain lacklustre. Nonetheless, the recent increase in personal income tax threshold and expansion in deductibles is expected to lift households’ income by about 3 percent. Consumer confidence should also get a lift from the buoyant stock markets, the report further noted.

Exports jumped to five-month high last month, though the scale of the rebound was partly due to the different timing of Lunar New Year and hefty price increases. Specifically, export prices rose 4.4 percent in Q1, contributing 66.3 percent of export growth.

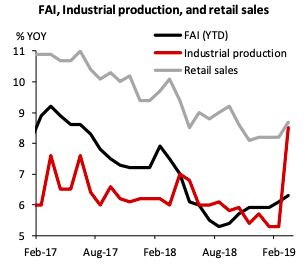

Emerging evidence of stimulus efficacy suggests that consumer expectation and investor confidence remain constructive. Consumption, in particular, is amenable to responding to well-targeted measures, as seen in the recent rebound in loans and retail sales figures.

This is a major source of comfort for China’s outlook as growth trends lower. Meanwhile, if growth deceleration becomes disorderly, the authorities will have the confidence that they have sufficient tools in their arsenal to stabilise the economy without having to sacrifice corporate deleveraging and associated moral hazard issue, DBS Research added in its report.

Image Courtesy: DBS Group Research

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock