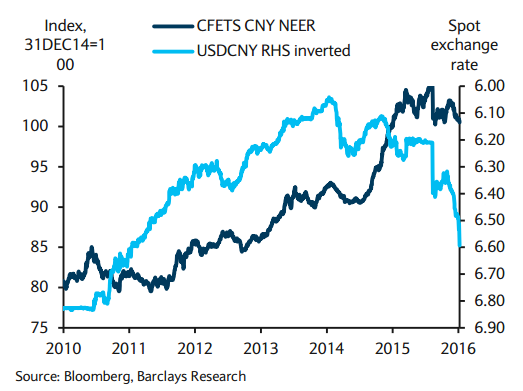

It is no surprise that the Asian currencies have started 2016 on a weak footing and we could see more pressure in the weeks ahead. Asian currencies which have already been beaten down by lower commodity prices, capital outflows and the Fed rate hike in 2015 are now facing the wrath of renewed CNY weakness. Renewed volatility in China, following weaker-than-expected economic data and lower PBoC guidance for Yuan hits EM and broader risk assets. Almost all EM currencies are falling year-to-date and high-beta FX are bearing the brunt of the pressure.

Downbeat data and sharp declines in Chinese equities and FX have fuelled renewed concerns about the health of China's economy and dented commodity prices. Renewed China-induced weakness in commodity prices will continue to hurt EM commodity exporters, while currencies exposed to the CNY will continue to suffer. KRW, TWD and SGD are Asian currencies most exposed to CNY depreciation pressures, while the indirect impact of commodity price weakness also weighed on MYR. Instability in China has also resulted in significant widening of EM credit spreads, with GCC and Turkey spreads underperforming in particular.

Chinese authorities have let CNH-CNY basis to widen more than they have in the past before intervening, prompting various questions about China's motives in allowing such weakness. The spread has widened to levels that authorities have become more uncomfortable with. This could follow an FX intervention in spot CNH in the offshore market to limit the widening of the spread. It is unlikely that the PBoC has set a target level for the USD/CNY and USD/CNH, but is rather attempting to instil a greater degree of two-way risk into the market, thus dampening speculation while allowing a greater degree of market influence on the currency.

Should there be any disruptions to oil supply on account of escalated tensions between Saudi Arabia and Iran, leading to upward pressure on oil prices, we could see some beneficial effects, at least for other beaten-up oil-related assets. However, while the risk of supply disruption is ever-present and has arguably increased, severe disruptions that could cause upside pressure on prices seem only a tailrisk scenario, with low probability. Indeed, after some initial volatility, oil prices have continued their slide and marked new multi-year lows.

Yuan firmed on Friday after the central bank guided the yuan's midpoint fix higher for the first time in 9 days on Friday. The midpoint was fixed at 6.5636 per dollar, firmer than the previous fix of 6.5646. Asian shares also rebounded on Friday, led by strong gains in battered Chinese stocks.

China induced volatility will continue to weigh on commodity and AxJ currencies

Friday, January 8, 2016 11:32 AM UTC

Editor's Picks

- Market Data

Most Popular

4

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand