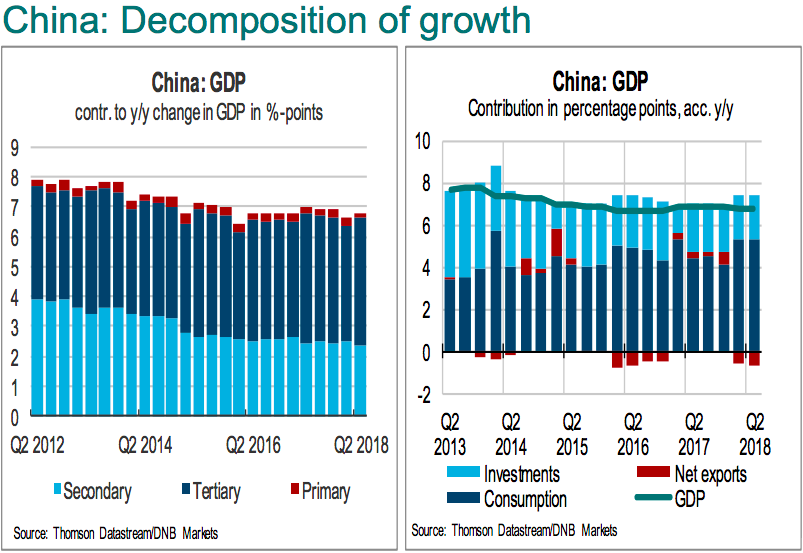

China’s gross domestic product (GDP) for the second quarter of this year cheered market participants while industrial production fell during the month of June. Underlying growth seems to be weakening after a strong development last year, as the drop in IP growth is showing signs of.

According to National Bureau of Statistics (NBS), Chinese GDP rose by 1.8 percent q/q in Q2, while the y/y growth rate fell by 0.1 percentage point to 6.7 percent y/y from Q1 to Q2.

Further, industrial production rose by 6.0 percentage y/y in June, while consensus had expected an increase of 6.5 percent y/y. Growth has slowed by 1 percentage point from April to June. The slowdown was broad based with a fall in the y/y growth rates for electricity, steel and glass, cement and iron ore.

In addition, retail sales rose by 9.0 percent y/y in June, up from 8.5 percent in May and higher than consensus’ expectations of an increase of 8.8 percent. Adjusted for price changes sales rose by 7.0 percent y/y, up by 0.2 percentage point from May.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions