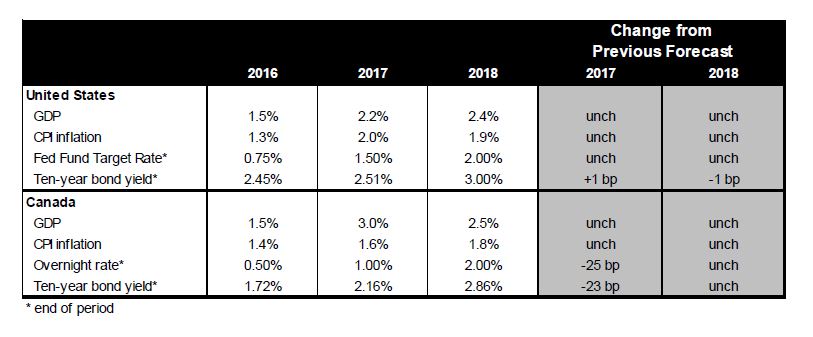

Despite a third-quarter slowdown, Canada’s economy remains on track to grow about 3.0 pct in 2017. Consumption spending, which took a breather in Q3, has been the major driver of growth this year benefiting from the confluence of favorable developments including the best labor market in years, the Canada Child Benefit program, low-interest rates, and wealth effects associated with surging home prices. So, while the Bank of Canada suggested it would remain in pause mode for a while, strong data may eventually force its hand early next year.

The Canadian economy seems to be taking a breather, albeit not surprisingly after a blistering first half of the year. Employment, which is contemporaneously correlated with real GDP growth, is softening as a result. According to the Labour Force Survey, just 43K jobs were created in Q3, the weakest quarterly performance in a year. And the few jobs created during the quarter were all in the “self-employment category”. So much so that paid and private sector employment saw quarterly declines for the first time since 2015.

Further evidence of a Q3 moderation in economic activity comes from the Bank of Canada's Business Outlook Survey. Respondents to the survey were less bullish than in the summer about future sales. As such, intentions to invest in machinery/equipment and to increase employment both fell compared to last summer. But the survey still pointed to reduced overall economic slack, with 47 percent of businesses stating either some or significant difficulty in meeting an unexpected increase in demand. Inflation expectations also edged up, with 40 percent of respondents (the highest share in five years) now expecting the annual inflation rate over the next two years to be above 2 percent.

While the Bank of Canada made clear in its October statement that it will be very cautious in raising interest rates from now on because “household spending is likely more sensitive to interest rates than in the past”, strong data may eventually force its hand.

Meanwhile, how many more interest rate hikes are delivered by the central bank next year will, of course, depend on the Federal Reserve’s own tightening cycle and on the economy’s response to foreign developments (e.g. NAFTA negotiations) and domestic ones including recently announced additional regulations on housing by the Office of the Superintendent of Financial Institutions.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal