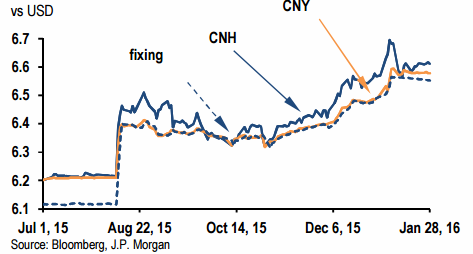

PBoC has shocked the markets twice in the past six months in its effort to depreciate CNY against the USD, first in August and then Dec 2015. Both the times markets evidenced intensified CNY depreciation expectations, large capital outflows and significant decline in China's FX reserves, not to forget global volatility. The cumulative depreciation achieved was about 3% in each episode and the CNY started to stabilize weeks after the central bank action. The uncertainty surrounding the CNY outlook, as well as the PBOC's policy intention, continues to pose a major risk factor for the global financial markets.

Can the PBoC successfully manage a shift towards a more flexible exchange rate regime in a controllable, less destructive way? Lack of transparent and poor communication from the PBOC reflects the internal debate amongst policymakers on the best possible strategy. As laid out by a recent article by Professor Yongding Yu, a senior research fellow at CASS and ex-MPC member, there are currently three policy options- a step back to peg CNY tightly to the USD, a shift towards a basket of currencies, or stop intervention and let the renminbi float. The choice is difficult, and the final decision will depend on policymakers' assessment on major currency movements, domestic and global growth outlook, and some judgment calls.

"The RMB exchange rates against other currencies in the basket have been basically stable, and there is no such ground to support its consistent depreciation." - quoted from Premier Li's telephone talk with IMF managing director, January 28, 2016.

The official view from China has reiterated that economic fundamentals (current account surplus, high GDP growth) do not support a depreciation trend of renminbi. However, capital flows have become much larger and can easily turn the boat around. China's current account surplus likely printed a new historical high at around $300bn in 2015, but capital outflows in the same year eroded around $640 bn from it. The large increase in capital outflows is a result of narrowing onshore-offshore interest rate differentials, lower investment return in China related to over-investment and over-capacity, and the reversion in currency expectations. The expectation component could play an important role, and managing expectation will be critical in policy implementation. The PBOC will keep the CNY stable in the very near term, but the next move remains a major uncertainty for the market.

"Markets remain very bearish on China and are not confident that the authorities can fix the problems of yuan depreciation and capital outflows," said Ken Cheung, a Hong Kong-based strategist at Mizuho Bank Ltd. "Selling the offshore yuan will remain the best proxy to execute a short-China strategy." he added.

China's yuan firmed on Wednesday as regulatory capital control measures helped cushion the usual increased demand for the dollar ahead of the Lunar New Year. The spot market opened at 6.5824 per dollar and was at 6.5798 at midday, little changed from the previous close, while offshore yuan was trading at 6.6287 per dollar, 0.74 percent weaker than the onshore spot rate.

Can PBoC make a successful transition towards a more flexible exchange rate?

Wednesday, February 3, 2016 10:09 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated