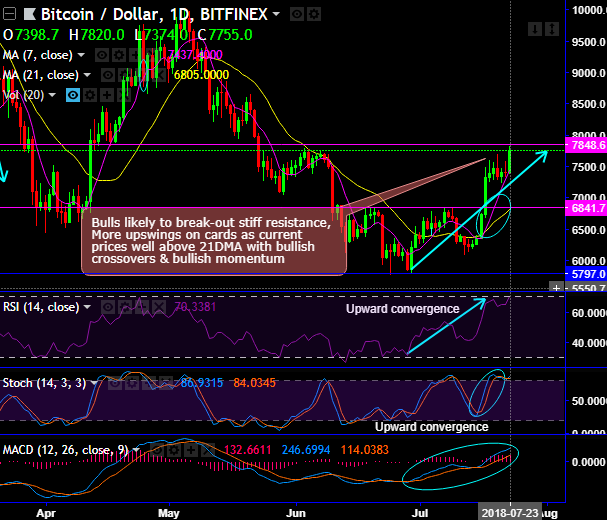

BTCUSD (at BITFINEX) has currently taken over the yesterday’s rallies from $7,719.80. Bulls have managed to break-out the stiff resistance as anticipated For now, more upswings on cards as current prices well above 21DMA with bullish crossovers & bullish momentum.

Streaks of optimistic news have propelled the BTC price spikes:

Bitcoin’s price, today, has resurged to $8,000 mark, and most likely to extend driven by a series of constructive news stories. Despite the constructive news, such as Custodian, Derivatives, OTC, and ETF services for cryptocurrencies to allure Institutional and HNI investors, it’s still a long ways away from December 2017’s all-time high, it could indicate that the long bear market is beginning to turn around.

Last two weeks of BTC rallies have taken above 21-DMAs, the bullish sentiments are intensified especially from the recent lows of $5,755 levels.

Amid this bullish price sentiment coupled with constructive fundamental driving forces, a recent tweet from CME Group, the first company to offer Bitcoin futures trading, reports that average daily trading volumes are up 93% and open interest surpassed 2,400 contracts, a 58% increase. We reiterate that the cryptocurrency market, during late last year, surged to $900 billion in valuation when BTC reached its all-time high to 20k. One can’t rule out that the real impact of Bitcoin futures was the price of bitcoin, achieved $20,000 during its announcements of CME introducing futures contracts and the price of ether broke $1,400.

While the SEC, recently announced that they propose to ease ETF approval rules, especially for low-risk ones, which in turn, the commission received various constructive responses. This would allow companies to issue “plain vanilla versions” of the ETF without seeking approval.

Consequently, BTC ETF has been one significant aspect that would, probably, allure the inflow of institutional and HNI funds into crypto-avenues. While there may be abundant BTC to invest in. For Bitcoin, the institutional money inflow in a fully legalized asset like an ETF would be an indication of authenticity. Some traditional finance firms have made forays into Bitcoin, but those were mostly small-scale test investments.

Currency Strength Index: FxWirePro's hourly BTC spot index has shown 112 (which is bullish), while USD is flashing at 82 (bullish) while articulating at 07:37 GMT.

For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge