Investors have pushed back their expectations of the first UK rate rise since the financial crisis to the last quarter of 2016 after BoE's MPC voted 8-1 to kept rates unchanged at 0.50% and the asset purchase target at £375bn at November's meeting. The pound Sterling slumped across the board after the BoE singled out the high level of sterling and lowered its inflation forecast for the next two years.

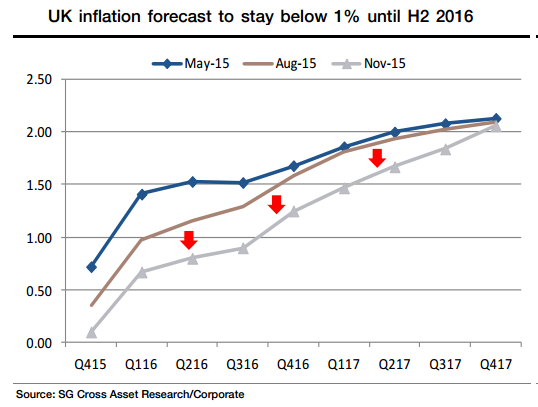

The BoE now believes UK inflation will stay below 1% until H2 2016 on account of sterling appreciation, lower commodity prices and downside risks to economic growth from emerging markets. Inflation was previously expected to return above 1% from Q2 next year. The forecast is based on a first increase in rates in Q2 2017 compared to the August forecast of Q3 2016.

"Overall, BoE data deluge and unexpectedly dovish signals raise the risk of delayed BoE tightening compared to our call for a first rate hike in Q1 2016. The chance of a delay in lift-off in BoE rates until Q2 2016 is now higher", says Nordea Bank in a note to its clients.

Sterling extended a fall, hit a one-month low against the dollar and also slipped against the euro on Friday, as investors cut favourable bets on the currency after the Bank of England chief Mark Carney suggested he was in no hurry to raise interest rates. With the Fed toeing a more hawkish line and the BoE exercising greater caution, a widening of US/UK 2y rate differentials (+5bp yesterday) could now further depress GBP/USD in the short-term.

NFP due today will be closely watched and should the data cement expectations for Fed a liftoff next month, GBP/USD could break below 1.5277 trendline support, which could open the door for a deeper pullback. October 13th low of 1.5201 stands in the way of a fall to October 1st low of 1.5108. A return below 1.50 is not ruled out in the medium-term on positioning ahead of the referendum on Brexit. The fall in the pound lifted EUR/GBP back over 0.7140 and from technically oversold conditions.

"The scope for a sustained rebound ought to be limited as investors position tactically by shorting the EUR ahead of a further possible monetary easing by the ECB in December. A return below 0.70 cannot be ruled out if the ECB surprises with a more substantial cut in the deposit rate next month. Our call is for a 10bp cut", notes Societe Generale in a research report.

Data earlier today showed that British manufacturing output rose in September at the fastest monthly pace since April 2014 and the country's goods trade deficit narrowed more than expected. Despite the improvement, the ONS said trade will likely make a negative contribution to British economic output in the third quarter. It said the latest industrial production figures would have a negligible impact to its estimate for economic growth in the July-Sept period, which slowed to 0.5 percent on the quarter. Sterling fell to $1.5169, down 0.3 percent on day, while the euro was up 0.2 percent at 71.65 pence.

British inflation to stay below 1 pct until H2 2016, Cable could be depressed further in short-term

Friday, November 6, 2015 11:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand