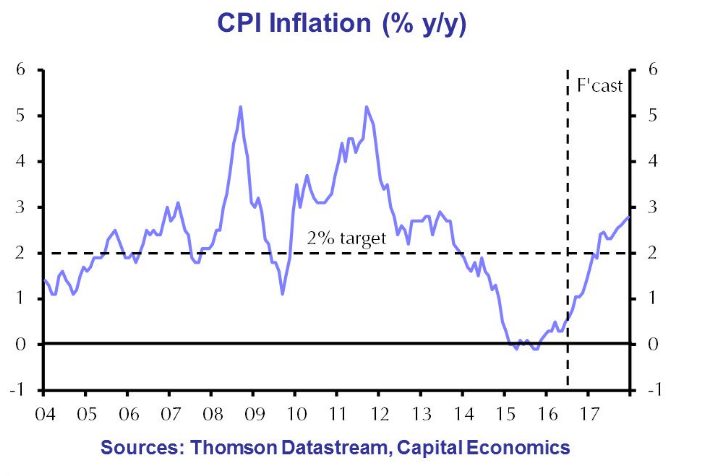

Data released by the Office for National Statistics on Tuesday showed that UK annual inflation rate as measured by the Consumer Prices Index (CPI) rose to 0.6 percent in July from 0.5 percent in June, beating expectations at 0.5 percent. The core inflation gauge (excluding energy, food, alcohol and tobacco) eased a bit to 1.3 percent in July versus 1.4 percent last, in line with expectations.

Today’s inflation report is the first official government data that covers the period after the EU referendum. There was no obvious impact from Brexit on today’s consumer price data, but it’s probably too early to spot signs of Brexit damage. It will be some time before the full effect of the fall in sterling following the Brexit vote feeds into the headline inflation rate. A weaker pound will cause inflation to rise more sharply in the coming months.

The pound is down by more than 12 percent since the EU referendum and almost 19 percent since its 2015 peak. Fall in the value of the pound had increased the cost of imports for manufacturers. Input prices faced by manufacturers rose 4.3 percent in the year to July, compared with a fall of 0.5 percent in the year to June. The cost of imported food materials rose 10.2 percent, and the price of imported metals rose 12.4 percent.

"There is no obvious impact on today's consumer prices figures following the EU referendum result, though the Producer Prices Index (PPI) suggests the fall in the exchange rate is beginning to push up import price faced by manufacturers," said Mike Prestwood, head of prices at the ONS.

Higher inflation will make it harder for the Bank of England to cut interest rates any further. The previously statically low headline inflation reading is now beginning to bounce higher in the first real set of data following the EU referendum vote. Joshua Mahony, of IG says "Inflation data doesn’t yet move the dial for the Bank of England’s monetary policy makers, who have arguably shifted their focus to growth and jobs in the wake of the referendum result."

The pound rallied after inflation rose faster than expected. The pound has gained almost one cent against the US dollar since the inflation report was released, to $1.2993. It has also recovered from three-year low against the euro, and was trading at €1.1506 at around 11:00 GMT, up from €1.1464 earlier.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment