Brent crude oil is expected to reach USD75/bbl by the first quarter of 2019, while the year-end target stands at USD65/bbl; further, the United States shale oil output is seen to keep rising over the next 18 months, according to the latest research report from ANZ Research.

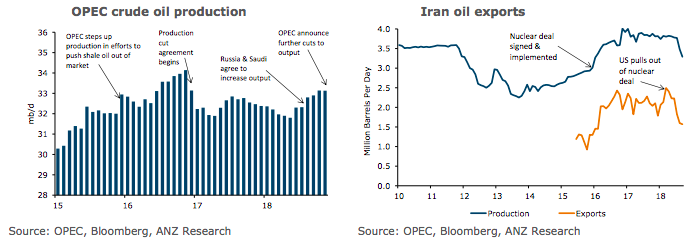

The agreement of a reduction in output of 1.2mb/d at last week’s OPEC meeting was much more than what we and the market had expected. The cuts will be based on production levels in October 2018 and are only expected to last for six months.

It will be split in the form of 800kb/d from OPEC members and 400kb/d from non-OPEC members. The agreement did not list any specific country targets. However Iran, Libya and Venezuela have been exempt from the agreement.

It is also expected that Saudi Arabia will make up most of the OPEC cuts, with Energy Minister Khalid Al-Falih saying production would be 10.2mb/d in January, down from 11.1mb/d in November. Overall, this should keep the market relatively balanced in 2019.

"Overall we have the market remaining in deficit in H1 2019, before weaker economic growth and the production cut agreement roll off, resulting in a balanced market. The risks of further supply disruptions, while relatively diminished remain elevated," the report commented.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election