Growth in Japan is holding up nicely and economic activity has gained momentum since 4Q16 with the pickup in the global capex and manufacturing cycle. Inflation has started to push back above the waterline. But as Governor Kuroda emphasized at a press conference last week, inflation expectations remain stuck, something highlighted by this year’s spring wage negotiation projected to produce only modest wage increases. With price pressures nailed to the floor, the Bank of Japan (BoJ) doesn't seem to be in a hurry to raise rates.

"With our USD rates forecasts pushed upward, we now expect that the BoJ will taper its asset purchases at a somewhat slower pace than previously and that QE will end in H2 2019, instead of mid-2019. JGB rates unchanged," said DNB markets in a research note to clients.

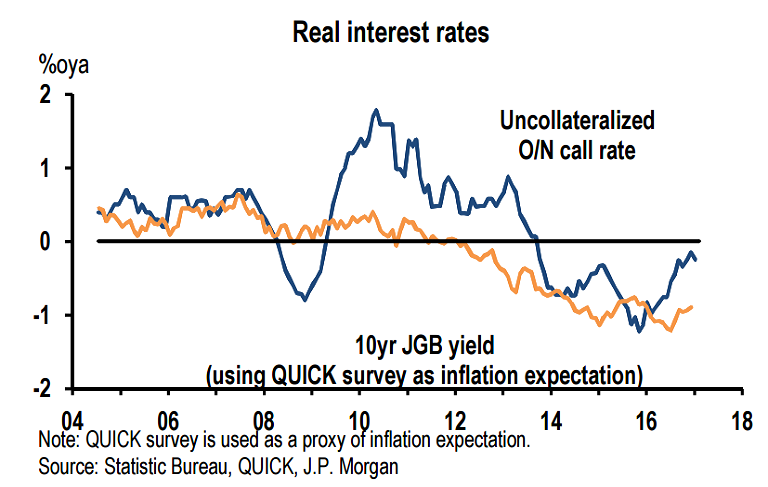

There is an ongoing debate whether the BoJ will have to raise its 10-year bond yield cap because of the lack of JGB liquidity. There seems to be still a split of views inside the BoJ on whether the Bank should or should not raise the 10-year yield target when the real interest rates decline further. The longer the BoJ keeps the 10-year yield target unchanged, the more rapidly it will have to adjust the target later.

Analysts expect the BoJ to maintain the current 10-year yield target through year-end, but if it sees greater yen weakness, it would adjust the target in 2H17. BoJ will have to strengthen communication strategy with forward guidance on its yield curve control (YCC) policy to manage market expectations. It would probably provide the conditions under which the BoJ would raise the 10-year yield target.

"While we expect the BoJ to introduce forward guidance on its yield curve control (YCC) policy relatively soon, we think it would do so in July at the earliest, when the BoJ reviews its economic outlook and discusses its monetary policy stance in the Outlook Report. If it may take time to build a consensus among the board members on this issue, delaying its introduction until October," said J.P. Morgan in a report.

USD/JPY trades below 100-day moving average. The pair is tracking DXY lower, amid holiday-thinned markets (Japan closed for Vernal Equinox Day) and lack of fresh fundamental drivers. Technical studies are bearish, RSI and stochs are biased lower and MACD has shown a bearish crossover on signal line. 112 levels in sight, violation there could see test of 111.60 and then 111 levels.

FxWirePro's Hourly USD Spot Index was at -151.246(Highly Bearish) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary