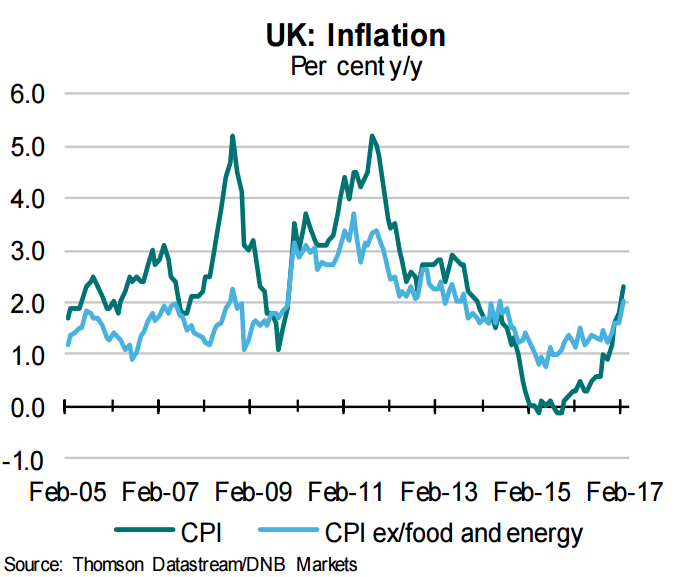

Stronger-than-expected U.K. inflation data for February will lead to speculation for a more hawkish sentiment towards BoE policy. Data released by the Office for National Statistics' showed Tuesday that UK Consumer Prices Index (CPI) spiked to 2.3 percent in February, up from 1.8 percent in January. UK inflation surged above the Bank of England’s 2.0 percent target for the first time in over three years in February.

"It remains likely that policymakers will adopt an increasingly dovish tone in coming months, despite the rise in inflation, as the economy slows due to consumers being squeezed by low pay and rising prices," said Chris Williamson Chief Business Economist, IHS Markit.

After last week’s BoE policy meeting generated slightly more hawkish noises from some MPC members, yesterday’s inflation figures provided a significant upside surprise. As in the recent months, transport costs remained the main driver of inflation due to higher oil prices and sterling depreciation. Going forward analysts expect CPI will likely rise close to 3 percent Y/Y by year-end and remain well above the BoE’s target through to 2019.

Further, as firms pass rising costs onto customers in coming months, more upward pressure on consumer prices looks almost certain. Recent PMI survey data show companies’ input costs increasing at a rate not exceeded since before the global financial crisis, due mainly to import costs surging higher as a result of the weakened pound. The same survey data indicate that average prices charged for goods and services are meanwhile rising at the fastest rate for almost six years.

But with real wage growth having already fallen below zero in January for the first time in almost 2½ years, further increases in inflation will push real income growth further into negative territory over coming months, weighing on consumption, the key driver of GDP growth over recent years. And also, concerns over the impending start of EU exit negotiations and demands from the SNP for a second independence referendum likely to keep BoE inclined towards a dovish policy bias.

"We maintain our view that the majority on the MPC will look through the period of above-target inflation and keep Bank Rate unchanged at its current level this year and probably beyond," said Daiwa Capital Markets in a report.

GBP/USD has posted an impressive recovery in recent days. The pair has bounced back to around 1.24 since hitting low of 1.21 earlier this month. On the day, the major was slightly weaker, down 0.27 percent. FxWirePro's Hourly USD Spot Index was at -41.1342 (Neutral), while Hourly GBP Spot Index was at 52.0817 (Neutral) at 1210 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices