Quotes from Barclays

- The Philippines February inflation was in line with expectations, but core inflation unexpectedly edged up to 2.5%, from 2.2% in January.

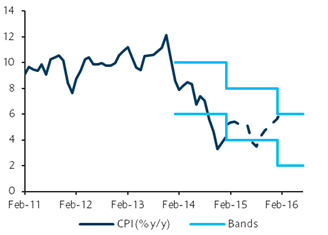

- Rice and overall food inflation continued to ease, and falls in petrol pump prices were further reflected in the CPI, but electricity tariffs and housing rentals picked up.At its 12 February policy meeting, the BSP lowered its 2015 inflation forecast to 2.3%, bringing it in line with our forecast.

- We expect inflation to stay broadly within the BSP's 2-4% target range this year, with lower energy prices and easing rice inflation partly mitigated by sticky core inflation.

- The BSP appears comfortable with its current policy stance, as although low inflation is leaving room to keep policy on hold, growth remains robust. On the latter, we note that Manila Port congestion which began in February 2014 has now been cleared, removing a key headwind to export growth.

- We continue to forecast the next policy rate hike will take place in Q4 15.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed