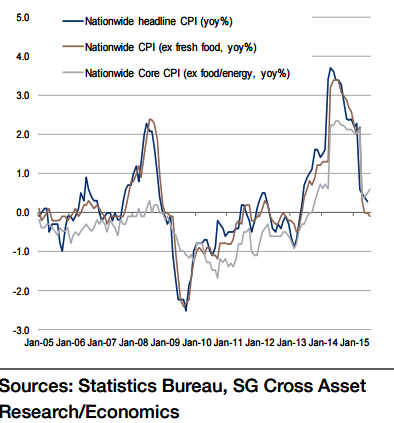

The BoJ stresses that inflation is strengthening as a result of yen depreciation and recovery in domestic demand, which is also putting upward pressure on food costs. In other words, the BoJ finds it difficult to capture all inflation merely by looking at "core CPI" (ex fresh food), which includes falling energy prices.

"In October, additional QQE measures are expected to be implemented, as the BoJ realises that the pace of economic recovery and inflation are both slower than initially expected, and given the growing risk for expected inflation to fall", says Societe Generale.

This is also the case for "core core CPI", which excludes food and energy. However, even this view will not alter the BoJ's commitment to achieve its 2% target. The 2% target is a firm objective, as it was decided not only by the BoJ, but was also included in PM Abe's LDP manifesto during the general election campaign of December 2014, which won the confidence of voters.

"Meanwhile, Tokyo CPI (ex fresh food) is expected to be +0.1% yoy in September, after falling to -0.1% yoy in August. CPI is expected to remain at 0% yoy for some time as there is no sign of acceleration in prices", added Societe Generale.

Bank of Japan's 2% inflation target to be a firm objective

Monday, September 21, 2015 6:31 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX