The members of the Monetary Policy Committee (MPC) were divided on whether or not to raise interest rates immediately. The split vote was 8-1 as Ian McCafferty voted in favour of increasing the Bank Rate by 25bp. However, analysts had expected a 7-2 vote so this result was actually to the dovish side. The MPC voted unanimously in favour of keeping the stock of purchased assets unchanged at GBP375bn.

Also the minutes were dovish. Greece was a material factor for the decision in July but was barely mentioned in the minutes from the August meeting. However, the minutes reveal that there are 'range of views among MPC members' on important topics, likely reflecting that data point in different directions. According to the minutes, there were different views on (1) 'the margin of spare capacity', (2) 'risks to inflation' and (3) 'costs and benefits of moving policy sooner or waiting longer'.

The minutes revealed that 'most members' think the lower oil price and strong sterling imply that the increase in inflation will be 'more gradual' than previously anticipated. 'Some members' see 'upside risks to the inflation forecasts' as growth is solid, slack in the labour market is diminishing and pay growth has increased more than previously expected. If inflation surprises on the upside in the coming months more members could vote in favour of increasing the Bank Rate soon.

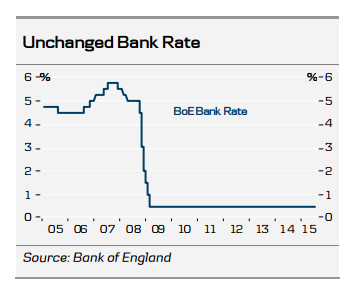

The projections for wage and GDP growth were revised up while the projection for the unemployment rate was more or less unchanged. The projection for inflation was revised down in the short-term but inflation is still expected to reach 2 % in Q3 17, i.e. in two years time. To conclude, the MPC members are still not confident with respect to inflation. There are five pre-conditions for the BoE to increase interest rates, Unemployment, Wages, Solid growth outlook, CPI inflation stabilised/moving higher, No financial stress. Hence, While unemployment is back to normal, wage growth is increasing and the growth outlook is solid, it still wants to see stabilizing/higher CPI inflation before hiking. In that respect, the lower oil price and stronger sterling pull down inflation and are main reasons for the quite dovish BoE.

Bank of England Review: Dovish BoE due to strong sterling and lower oil price

Thursday, August 6, 2015 8:47 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022