The Bank of Canada (BoC) at its March monetary policy meeting held interest rates unchanged at 0.5 percent as widely expected. The central bank has consistently signalled its concerns about lingering downside risks to the economy and made clear it would be ready for another rate cut, if necessary. That said, data from Canada have turned quite upbeat in the recent weeks skewing risks toward the next move being a hike.

BMO Capital Markets lifted their call for this year’s Canadian growth rate by a hefty 0.3 percentage points to 2.3 percent compared to prior consensus at 1.9 percent. BMO stated a run of better-than-expected domestic data so far in 2017 alongside solid employment gains in recent months which continued in February as the main driver. Canadian auto and home sales keep chugging along, suggesting that consumption is still holding strong.

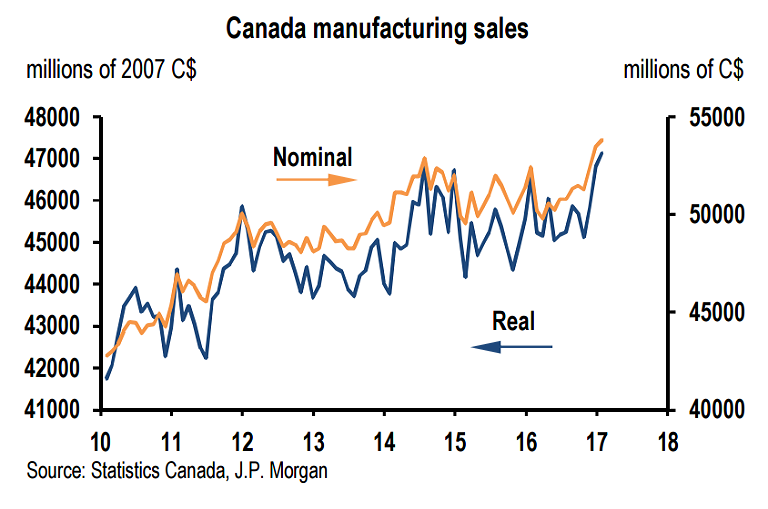

Data released last week saw a surprise decline in the unemployment rate. Canadian real manufacturing sales expanded to a new high and signs of reacceleration seen in the housing market. This recent run of positive news suggests that export industries and the business sector are beginning to shake off the drag from low oil prices and to benefit from the weak Canadian currency.

Overall, recent data on the global and Canadian economies have been consistent with the central Bank’s projection of improving growth, as set out in the January Monetary Policy Report (MPR). The recent consumption and housing indicators suggest growth in the fourth quarter of 2016 may have been slightly stronger than expected.

The next meeting of the BoC is scheduled for 12 April 2017 when the next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time. The Bank’s Governing Council has said that it remains attentive to the impact of significant uncertainties weighing on the outlook and continues to monitor risks outlined in the January MPR. Despite the BoC's dovish bias, analysts feel risks are shifting toward the next move being a hike.

"Continued positive economic data should ease these concerns and the expectation of a tighter monetary policy should support CAD," said Commerzbank in a report.

USD/CAD was trading at 1.3330 at the time of writing. The pair is extending downside from 2017 highs of 1.3535 hit on March 9th. Daily Ichimoku cloud offers strong support at 1.3283. Violation there could see drag upto 200-day MA at 1.3181. FxWirePro's Hourly USD Spot Index was at -159.676 (Bullish), while Hourly CAD Spot Index was at -84.9264 (Bearish) at 0930 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target