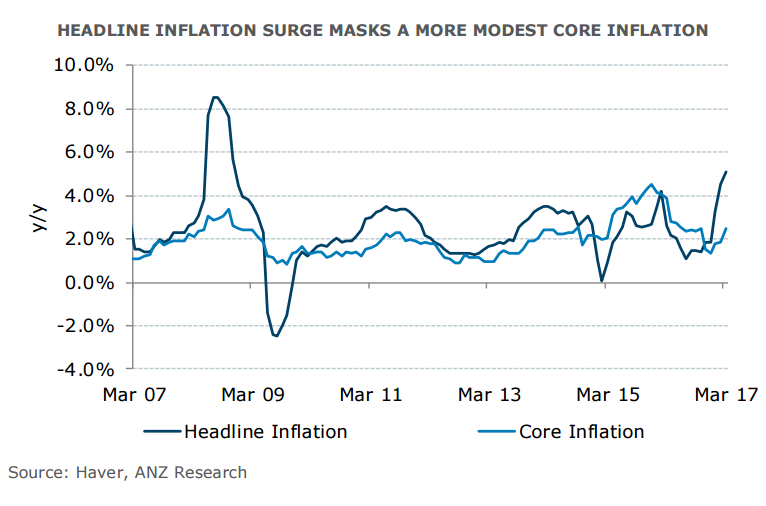

Malaysia's consumer price inflation hit an eight-year high in March, data released by the Malaysian statistics department showed on Wednesday. Malaysia’s headline inflation accelerated to 5.1 percent in March, from 4.5 percent in the previous month. The rise was slightly below the forecast in a Reuters poll at 5.2 percent.

Low-base effect and higher retail fuel prices exacerbated the rise in headline inflation. Fuel prices have a weighting of 7.8 percent in the CPI basket and a 48 percent y/y average increase in domestic fuel prices and the attendant knock-on impact on transport costs was seen as the main driver. Core inflation, which excludes volatile items of fresh food and administered prices of goods and services, remained stable at 2.5 percent y/y.

For April, inflation is likely to remain elevated. Notwithstanding increases in energy and food prices, the prices in other categories have remained relatively benign. Analysts expect core inflation to stay relatively modest, as growth is likely to remain under pressure. Growth dynamics also do not point to the emergence of strong demand-pull inflationary pressures.

"We expect headline inflation to be more volatile from April onwards as fuel prices, which have a weighting of 7.8% in the CPI basket, have been adjusted on a weekly basis since 30 March. We expect the weekly fuel adjustments month-to-date to add around 1.8ppt to April’s headline CPI print," said ANZ in a report.

Bank Negara Malaysia (BNM) said headline inflation will be "relatively high" in the first half of 2017 on higher fuel prices, but expects it to dip in the second half. BNM expects headline inflation to be 3 to 4 percent in 2017, against 2.1 percent last year. Accordingly, today's inflation spike is not expected to push the central bank to change its stance on monetary policy.

"BNM will likely peer through the inflation ascent and the central bank is likely to maintain its policy rate at 3% through 2017," adds ANZ.

USD/MYR was trading 0.29 percent lower on the day at around 4.3960 at 1130 GMT. Price action has been ranging since Jan 2017 and we see scope for downside. Price action has dipped below the daily Ichimoku cloud. Major support on the downside is seen at 4.2931 which is the 200-day moving average.

FxWirePro's Hourly USD Spot Index was at -67.1594 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target