The Brazilain real soared 10% against the dollar Q1 2016 as markets bet that attempts to impeach President Dilma Rousseff would lead to a new government that could help boost business confidence and curb a record fiscal deficit. If the Congress decides to oust Rouseff when it votes on Sunday, she would be suspended for up to six months while the Senate determines her fate. Rouseff's departure would likely bring only more political turmoil and push Brazil's faltering economy, into further chaos.

"A fractured Congress means that any government would struggle to pass the tough reforms that are required to put the economy onto a sustainable growth path," said David Rees, an economist at Capital Economics.

Brazil currently experiences its worst economic performance since the 1930’s, and with a combination of high inflation and large declines in terms of trade is unlikely to see much improvement. Brazil's economy is shrinking even faster than fellow emerging market with its GDP lagging far behind the rest of the "BRICs". 2016 is unlikely to see a significant change following last year’s -3.8% GDP decline. Economists at Commerzbank forecast a further decline of 3.6%.

Barzil's terms of trade have deteriorated considerably, thanks to the falling commodities prices. And should China's economy falter, Brazil will face continued hardship from this side. Inflation rates have spiked in 2015 alongside the slide in the Brazilian real. March 2016 CPI levels printed around 9.39% in y/y terms, which is way above BCB’s 4.5% inflation target. On Tuesday, the International Monetary Fund said that drag on the region will continue for the next two years, as weak commodity prices and widespread inflation batter the prospects for growth.

Poor fundamentals argue that the central bank will not want excessive BRL appreciation. In a surprise move, the central bank stepped up efforts to weaken the currency. The central bank sold 160,000 foreign-exchange reverse swaps in five different auctions Tuesday. It was the biggest sale on a single day since the introduction of the contracts in 2015.

“The intensification in the central bank intervention is strong,” Pablo Spyer, operational director at Mirae Asset Wealth Management, said from Sao Paulo. “The impression is that the central bank just wants to reduce volatility in the currency, which is very high.”

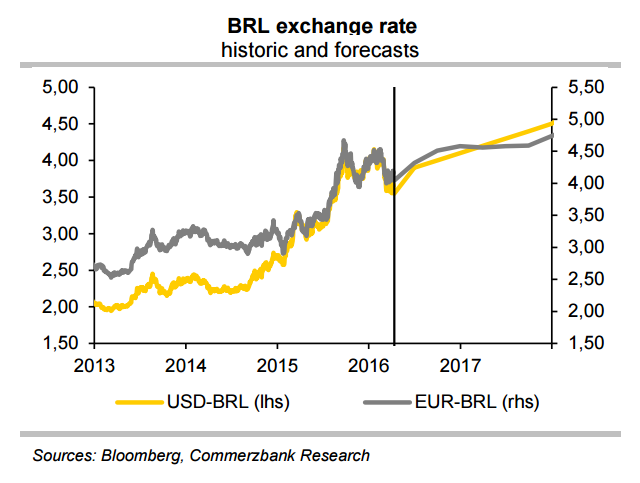

However, a record US$8 billion intervention by Brazil's central bank couldn't keep the real from climbing to the highest level since August. The real advanced 0.1 per cent Tuesday to its strongest level since Aug 20, after declining as much as 2 per cent earlier in the day. USD/BRL closed Tuesday's trade at 3.4887 and the pair was trading at 3.4885 at 1200 GMT.

"Should the central bank undertake a rate cutting cycle, this will diminish the appeal of BRL over the medium term. We think USD-BRL can easily trade towards 4.10 by year end 2016." said Commerzbank in a report to clients.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings