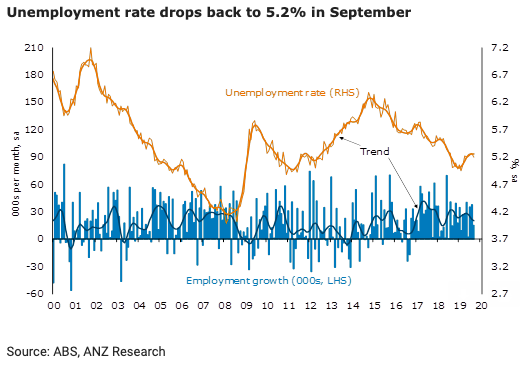

The 14.7k rise in employment in September was the smallest in seven months, aside from the post-election correction in June. However, the 0.1ppt fall in the participation rate to 66.1 percent meant that it was enough to bring the unemployment rate back down to 5.2 percent, ANZ Research reported.

Full-time employment increased by 26.2k, more than making up the previous month’s loss, while part-time employment fell 11.4k.

The fall in the participation rate was entirely due to males, with the female participation rate holding steady at the record high of 61.2 percent. Yet the male unemployment rate actually increased to 5.4 percent, due to a 6.7k decline in employment, while the female unemployment rate dropped to 5.0 percent on the back of a solid 21.4k rise in employment.

Along with unemployment, the underemployment rate fell 0.2ppt to 8.3 percent, bringing underutilisation down to 13.5 percent from 13.8 percent in the previous month. However, it remains 0.5ppt higher than its February low of 13.0 percent.

Still, the reduction in slack provides the RBA with some near-term breathing space and reduces the prospect of another rate cut as soon as November, the report added.

Not for long, though. With employment growth expected to slow in the near-term, we could see the unemployment rate drift up again. The outlook is dependent on the participation rate. High household debt and persistently low wage growth may be encouraging people to stay in the workforce longer or additional household members to look for work.

"These push factors could keep participation higher than we would otherwise expect as employment growth slows, driving up unemployment and preventing the RBA from its goal to “reach full employment," ANZ Research further commented.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal